USD Index loses the grip and revisits 109.50

- The index comes under pressure and slips back to 109.50.

- The Federal Reserve starts its 2-day meeting later on Tuesday.

- Housing Starts, Building Permits next of note in the US calendar.

The USD Index (DXY), which gauges the greenback vs. a bundle of its main rivals, extends the gradual decline and hovers around the 109.50 region on turnaround Tuesday.

USD Index looks prudent ahead of FOMC

The index so far clinches its third consecutive daily pullback and extends the corrective downside from last week’s peaks past the 110.00 hurdle amidst the lack of a clear direction in the global markets and swelling cautiousness ahead of the FOMC event on Wednesday.

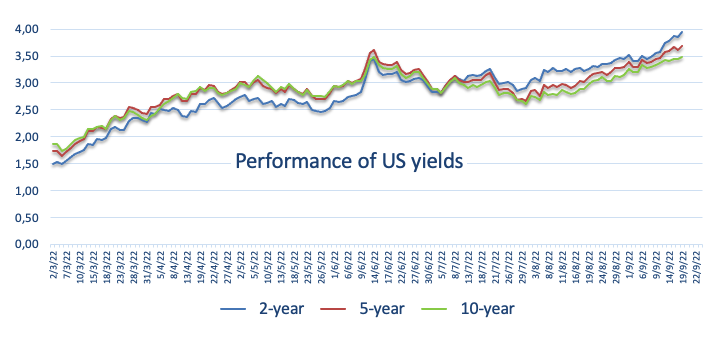

Some loss of momentum in US yields also accompany the slow decline in the dollar on Tuesday, as market participants seem to have already fully priced in a ¾ point interest rate raise by the Fed on Wednesday. Despite a 100 bps rate hike still remains on the table, its probability has dwindled to around 16% according to CME Group’s FedWatch Tool.

In the US data space, the housing sector will take centre stage in light of the publication of Building Permits and Housing Starts for the month of August.

What to look for around USD

The dollar grinds lower after climbing as high as the area above the 110.00 barrier in past days.

Bolstering the dollar’s underlying positive stance appears the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market.

Looking at the more macro scenario, the greenback appears propped up by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Building Permits, Housing Starts (Tuesday) – MBA Mortgage Applications, Existing Home Sales, FOMC Interest Rate decision, Powell press conference (Wednesday) – Initial Claims, CB Leading Index (Thursday) – Flash Manufacturing/Services PMIs, Powell speech (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation over a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.04% at 109.54 and faces the next contention at 107.68 (monthly low September 13) followed by 107.58 (weekly low August 26) and finally 105.88 (100-day SMA). On the upside, a breakout of 110.26 (weekly high September 16) would expose 110.78 (2022 high September 7) and then 111.90 (weekly high September 6 2002).