USD/CAD Price Analysis: Bulls attacking the upside, eyes towards 1.2500

- USD/CAD is leaning with a bullish bias from a weekly, daily and hourly perspective.

- The bulls are on the verge of a break of the daily H&S neckline.

USD/CAD has been on the backfoot for the month of October so far and sharply so. However, there appears to be a short of momentum into the bull's hands which is illustrated in the following top-down analysis below:

USD/CAD weekly chart

The weekly chart is showing signs of stability at this juncture and a retest of the old support that would be expected to act as resistance this time around is a high probability. This would equate to a bid from what is looking like the makings of a dynamic supporting trendline into the neckline of the M-formation near 1.2500. Should that hold, then the risks will shift to the downside for a restest of the territory below the dynamic support.

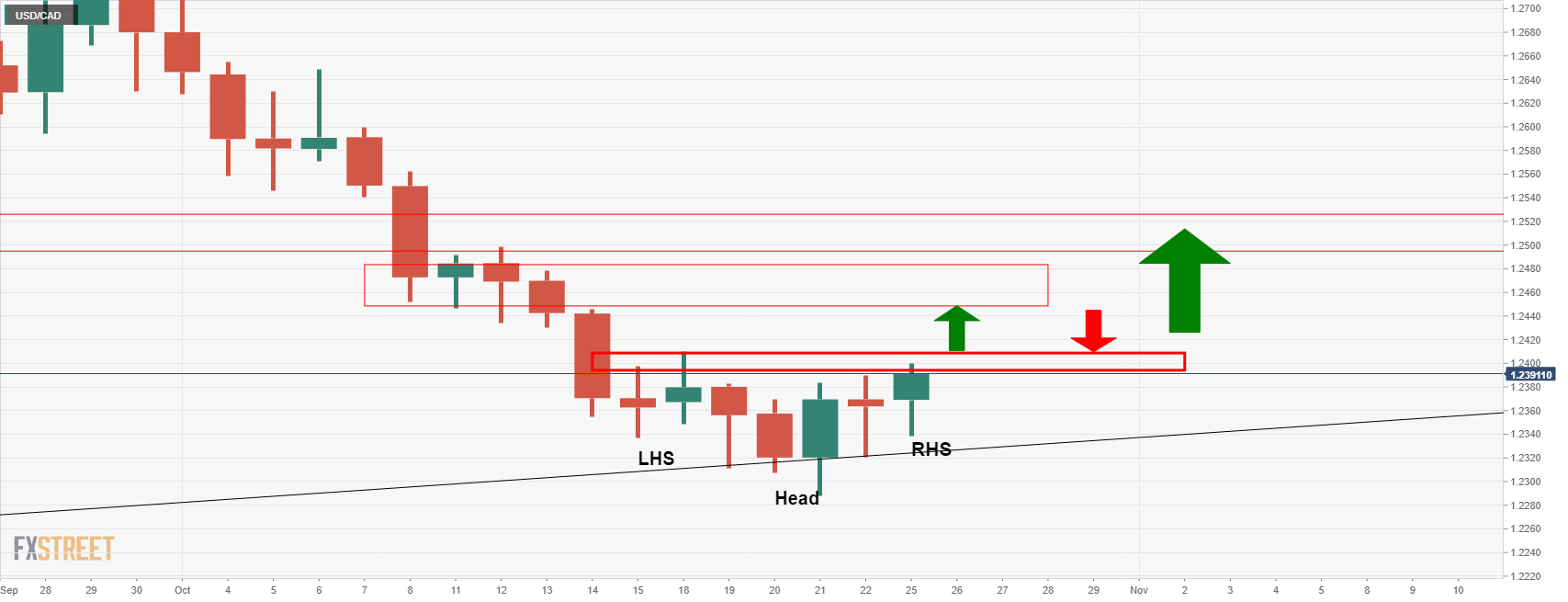

USD/CAD daily chart

From a daily perspective, we have the makings of a reverse head and shoulders which aligns with the weekly bullish outlook. If the price breaks the neckline resistance, then there will be more resistance expected within the 11 Oct daily candle's range. this could lead to rejection on the first attempt and a restest of the H&S's neckline near to 1.2410 prior to the move into the weekly chart's neckline target near 1.2500.

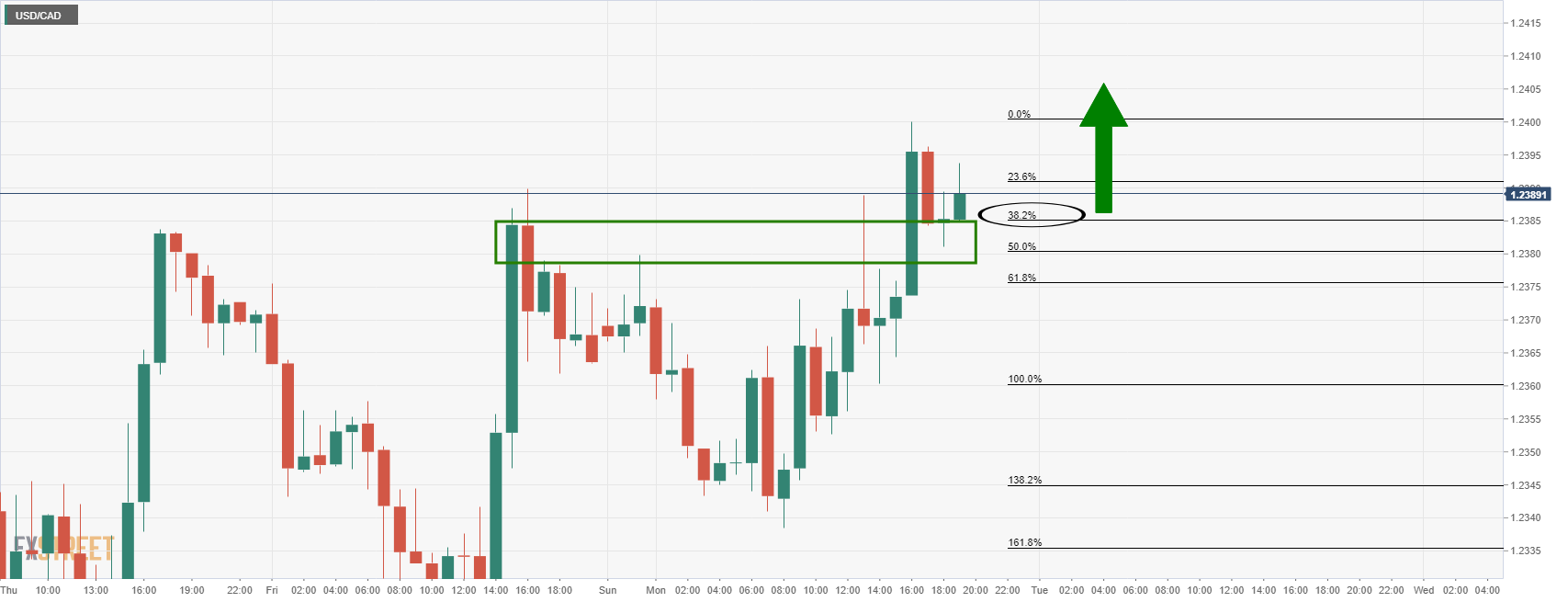

USD/CAD hourly chart

The hourly chart also represents a bullish bias in that the price has already corrected to the 38.2% Fibonacci retracement level of the recent bullish hourly impulse. This is a level where demand could lead to an eventual rally and fresh bullish impulse, in line with the break of the daily H&S neckline.