EUR/USD bulls pressured to the 61.8% golden ratio, waiting on ECB

- EUR/USD bulls protecting the 61.8% ratio ahead of ECB.

- ECB is the main event for the single unit for the next few sessions.

- Risk-off leading into the ECB is helping the US dollar to run higher within its daily correction.

EUR/USD is trading offered mid-week as the US dollar continues to recover from a higher daily as per the DXY in a 50% mean reversion of the August top to post-Nonfarm Payrolls Sep 3 low; (See below).

At 1.1823, EUR/USD is 0.15% lower on the day before the European Central Bank is due to meet, an event that European markets on Wednesday braced for, weighing heavily on European stocks.

EUR/USD has travelled from a high of 1.1851 to a New York morning low of 1.1802 so far as investors' move away from riskier assets which have weighed on risk currencies and lifted the dollar to one-week highs.

Despite last Friday's dismal Nonfarm Payrolls data from the US, the greenback has picked up a safe-haven bid in the face of lower risk sentiment pertaining to the concerns for the hard to contain Delta coronavirus global spread.

World stocks edged away from the previous day's record highs on Wednesday and Wall Street retreated on uncertainty over the pace of economic recovery.

MSCI's world equity index IACWI closed -1.57% on Wednesday, en route to the 38.2% ratio of the mid-August rally.

Wall Street's benchmarks are lower by various degrees, with the Dow Jones Industrial Average down 0.46 %and the S&P 500 0.22% lower. The Nasdaq Composite is also off today, falling by 0.46% at the time of writing, which just goes to show how bearish investors are this week.

Euro stocks reeling in face of high inflation and hawkish ECB

Lastly, European stocks skidded to their lowest in nearly three weeks and were down 1%. Britain's FTSE 100 hit two-week lows, down 0.69%.

Eurozone inflation is at its highest levels in nearly a decade and markets have presumed that the European Central Bank is on the verge of tapering its asset purchases, potentially starting the process at Thursday's meeting.

This sentiment was started since Philip Lane, Member of the Executive Board of the ECB, kicked up a stir at the Jackson Hole.

Lane was basically promising to calibrate the QE program to financial conditions BOTH in an upwards and in a downwards direction.

This currently means that the recent new all-time lows seen in EUR real rates could be used as an argument to tone down PEPP-purchases, potentially as soon as this month. The message has been construed as hawkish and the equivalent of a taper.

"Fears that central banks might start to taper their asset purchases seems to have knocked away a little confidence, particularly given tomorrow’s ECB decision where many expect we’ll begin to see the start of that process," Deutsche Bank analysts said in a note.

You can't keep a good dollar down

Meanwhile, the US dollar is proving to be robust, even in the face of the surge in COVID-19 deaths in the United States.

Reuters data shows that more than 20,800 people died from the virus in the past two weeks, up about two-thirds from the prior comparable period.

President Joe Biden will be speaking to the nation on Thursday with an outline of a plan to tackle the highly contagious Delta variant.

More on this here: US Coronavirus Delta spike: The caveat to US dollar strength and the Fed's max employment goal

Instead, the US dollar, as measured against a basket of major peers in the DXY index, is trading 0.11% higher on the day at 92.625. However, it had reached as high as 92.862 in the New Yorks mid-morning session.

While the Nonfarm Payrolls missed expectations by a mile, it was still only one of a series of highly strong data and still showed job gains despite what was the peak of the Delta at the time, during August.

Markets could be underestimating the prospects of a hawkish turn at the Fed.

Of course, the data meant that expectations of an imminent taper were dialled back.

However, while the Fed will likely forgo announcing a taper of stimulus at this month's policy meeting, wage growth remains solid. This means that there is the potential for inflationary pressures to steer the hand of the Fed.

This month's meeting remains a wild card for the US dollar and markets. The Fed could still signal a hawkish tone towards a taper before the year is out, despite the jobs slow down in August.

For instance, St. Louis Fed president James Bullard recently told the Financial Times that the central bank should go forward with a plan to start trimming stimulus this year despite the data.

We have more recently heard from New York Federal Reserve President John Williams singing the same tune as his hawkish colleague, Bullard:

Fed's Williams: Appropriate to start reducing pace of asset purchases this year

Fed's Williams: Asset valuations are very high

Such hawkish rebuttal is bullish fuel for the greenback in a risk-off environment and it should continue to see the euro pressure into the ECB meeting.

EUR/USD & DXY technical analysis

The DXY is on the verge of a retest of the counter trendline as follows:

A test of the 50% mean reversion is bullish while the index is above the 50-day EMA.

The bigger test for the bulls will be the counter trendline.

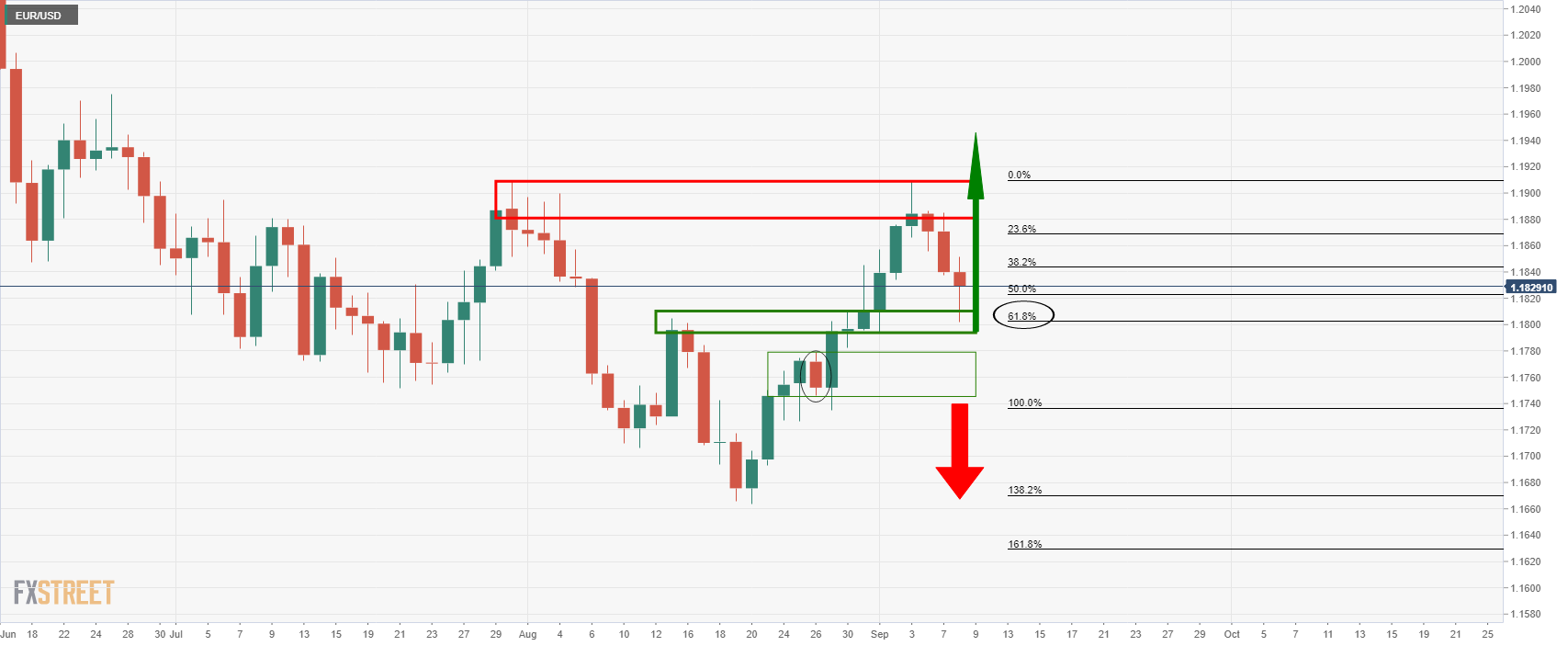

Meanwhile, the euro is stalling the decline at the 61.8% Fibonacci retracement. If the greenback fails to move higher, then there will be prospects of a retest of the 1.1880 and 1.1900 round-number resistance:

Failures below the 61.8% ratio will open risk to the next support block in the mid 1.17 area which guards the risk of a significant downside breakout.