US Dollar Index struggles for direction around 90.00

- DXY navigates a tight range around the 90.00 level.

- US markets remain closed on Memorial Day holiday.

- US Nonfarm Payrolls will take centre stage later in the week.

The greenback trades without clear direction around the 90.00 neighbourhood when tracked by the US Dollar Index (DXY) at the beginning of the week.

US Dollar Index remains capped by 90.50

The index exchanges gains with losses around the 90.00 area on Monday amidst scarce volatility and reduced trade conditions in the global markets due to the US Memorial Day holiday.

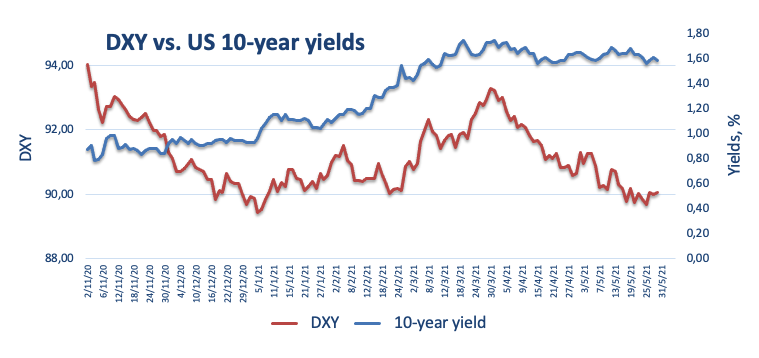

In the meantime, the index looks side-lined after being rejected from last week’s peaks in the vicinity of the 90.50 region amidst the corrective downside in yields of the key US 10-year reference and alternating risk appetite trends.

Moving forward, investors will closely follow the publication of the May’s Nonfarm Payrolls (Friday) and the ISM Manufacturing (Tuesday), as key drivers of the mood around the buck in the very near-term.

What to look for around USD

The index remains under pressure near 90.00 and after fading the recent bullish attempt to the 90.50 region in past sessions. Looking at the broader scenario, the negative stance on the dollar seems to prevail among market participants, as speculation of higher inflation in the medium-term now looks to have lost momentum and the US economic outperformance narrative seems almost fully priced in. Bolstering the bearish view on the buck emerges further confirmation of the Fed’s mega-accommodative stance for the foreseeable future, as per recent FOMC Minutes and Fed-speakers.

Key events in the US this week: ISM Manufacturing, final Markit’s Manufacturing PMI (Monday) – Fed’s Beige Book (Wednesday) – ADP Report, Initial Claims, ISM Non-Manufacturing (Thursday) – Nonfarm Payrolls, Factory Orders (Friday).

Eminent issues on the back boiler: Biden’s plans to support infrastructure and families, worth nearly $6 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

Now, the index is losing 0.02% at 90.03 and faces the next contention at 89.53 (monthly low May 25) followed by 89.20 (2021 low Jan.6) and then 88.94 (monthly low March 2018). On the upside, a breakout of 90.90 (weekly high May 13) would open the door to 91.07 (100-day SMA) and finally 91.43 (monthly high May 5).