Gold Price Analysis: XAU/USD sellers need $1,763 breakdown to keep reins

- Gold remains on the back foot for the second consecutive day.

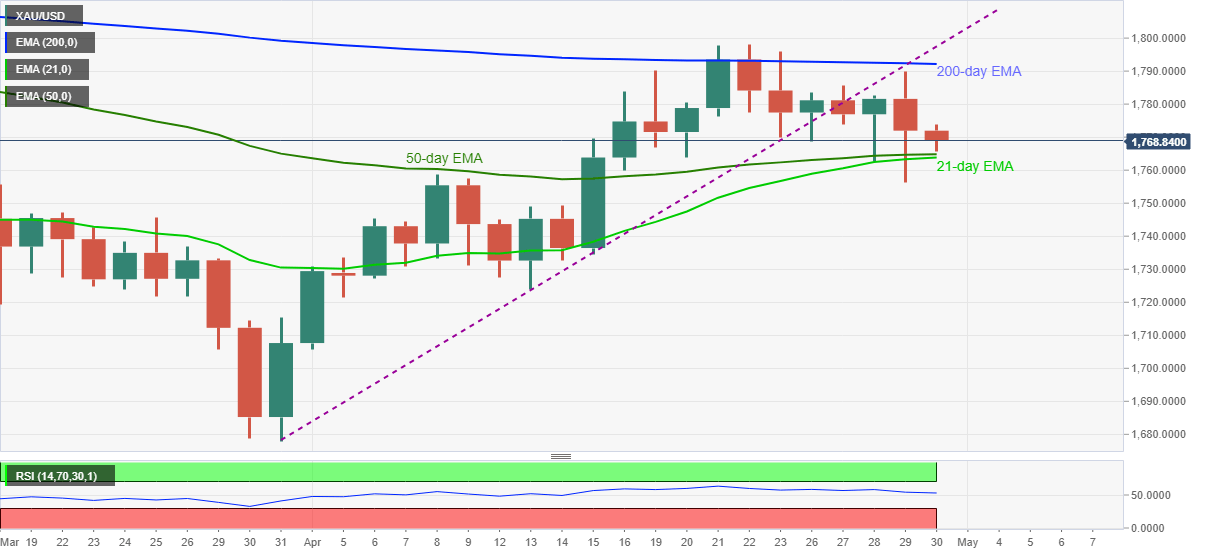

- 21-day, 50-day EMA convergence restricts immediate downside, $1,798 holds the key for buyer’s entry.

Gold trims intraday losses while picking bids around $1,768.50, down 0.20%, heading into Friday’s European session.

In doing so, the bright metal justifies late Thursday’s bounce off a two-week low, not to forget the failure to provide a daily closing below 21-day and 50-day EMA confluence.

Given the downward sloping RSI line, gold sellers are likely to stay in the power but will have to break the key $1,763 support to ward off the upside risk.

Meanwhile, 200-day EMA near $1,792 guards the bullion’s short-term upside ahead of the previous support line and the monthly peak surrounding $1,798.

It should, however, be noted that the gold bulls may wait for a clear run-up beyond the $1,800 threshold before challenging February’s top close to the $1,816.

Gold daily chart

Trend: Further weakness expected