AUD/USD Price Analysis: Has the room to rise towards 0.7850 amid favorable technicals

- AUD/USD clinches fresh seven-week highs, briefly regains 0.7800.

- The aussie’s daily chart shows scope for additional upside.

- RSI points north, as the bulls eye the horizontal trendline resistance.

AUD/USD is battling 0.7800, sitting at the highest levels in seven weeks, as the sentiment remains underpinned by broad-based US dollar weakness.

The covid vaccine rollouts driven global economic optimism continues to weigh on the haven demand for the greenback. The dovish RBA minutes and PBOC’s inaction failed to have any impact on the aussie.

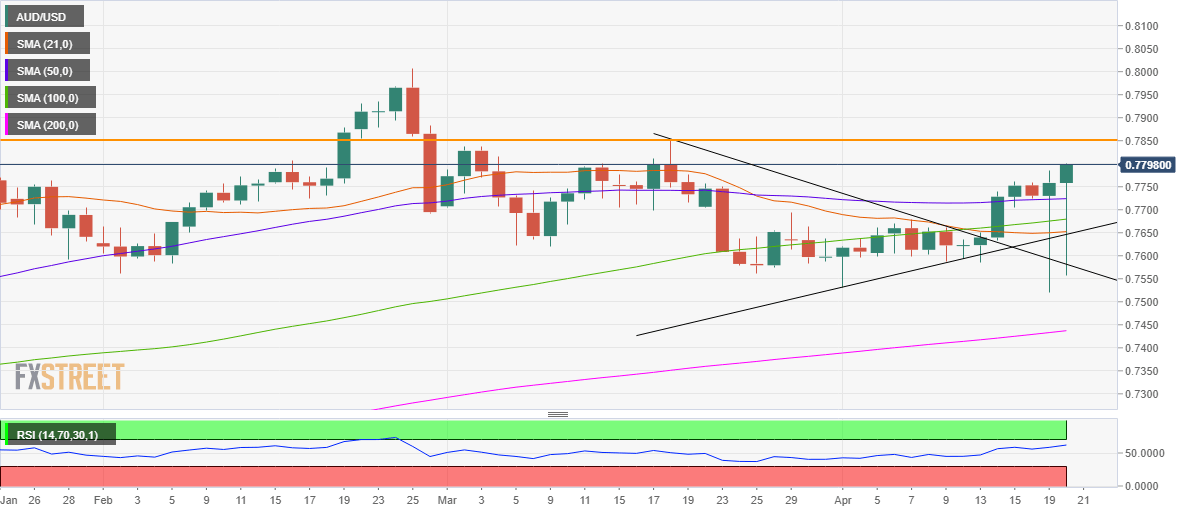

From a near-term technical perspective, AUD/USD remains on track to challenge the horizontal (orange) trendline resistance at 0.7853, as the upside break from the symmetrical triangle extends into a fresh week.

The February 26 high of 0.7884 remains next on the buyers’ radars.

With the Relative Strength Index (RSI) pointing upwards, near 62.02, the upside appears more compelling for the aussie.

AUD/USD daily chart

To the downside, immediate support awaits at the horizontal 50-daily moving average (DMA) at 0.7724.

The round number at 0.7700 could then challenge the bearish commitments.

The mildly bullish 100-DMA at 0.7679 will likely come to the AUD bulls’ rescue.

AUD/USD additional levels to watch