Back

15 Mar 2021

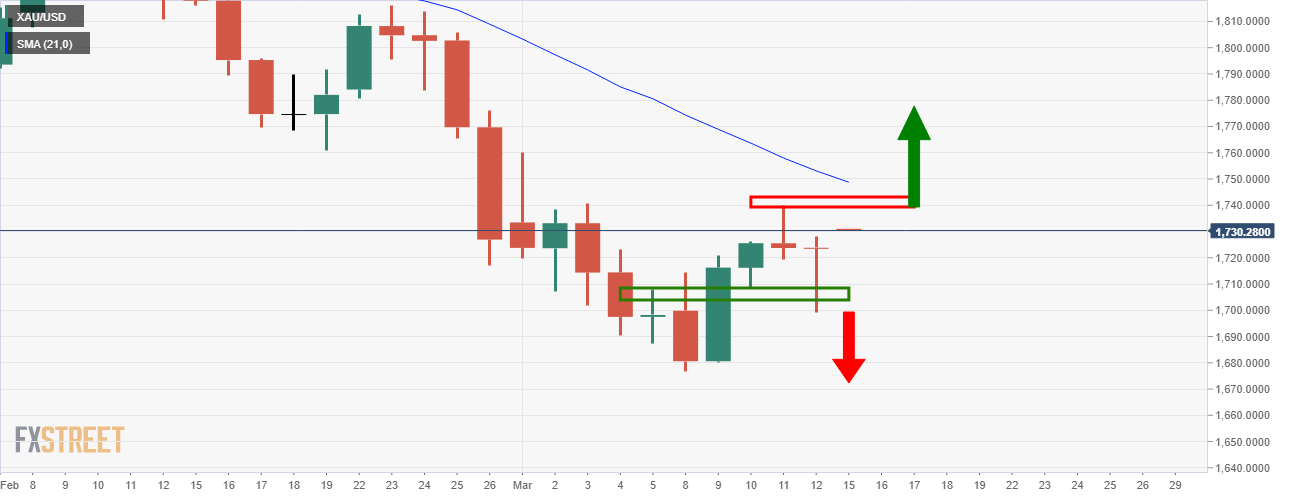

Gold Price Analysis: Bulls target $1,740/60

- Gold prices are attempting to correct higher from cycle lows.

- Bulls target 1760/80 territory while a break of $1,700 exposes risks for lower lows.

The daily chart is compelling in that there has already been a test of $1,700 and $1,740 resistance, both of which are guaranteed to open risk to either a lower cycle low or a significant recovery high.

If $1,740 gives, $1,760 will guard $1,780 resistance.

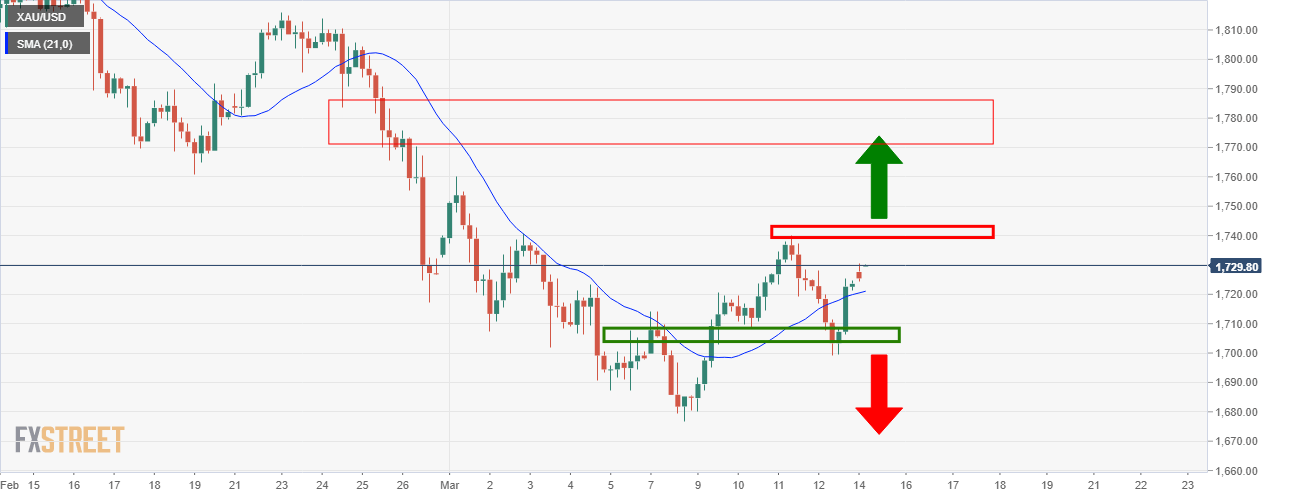

4-hour chart

From a 4-hour perspective, the price is in bullish territory above the 21-SMA.