US Dollar Index Price Analysis: Drops back towards fortnight-old support below 91.00

- DXY extends pullback from highest in one month.

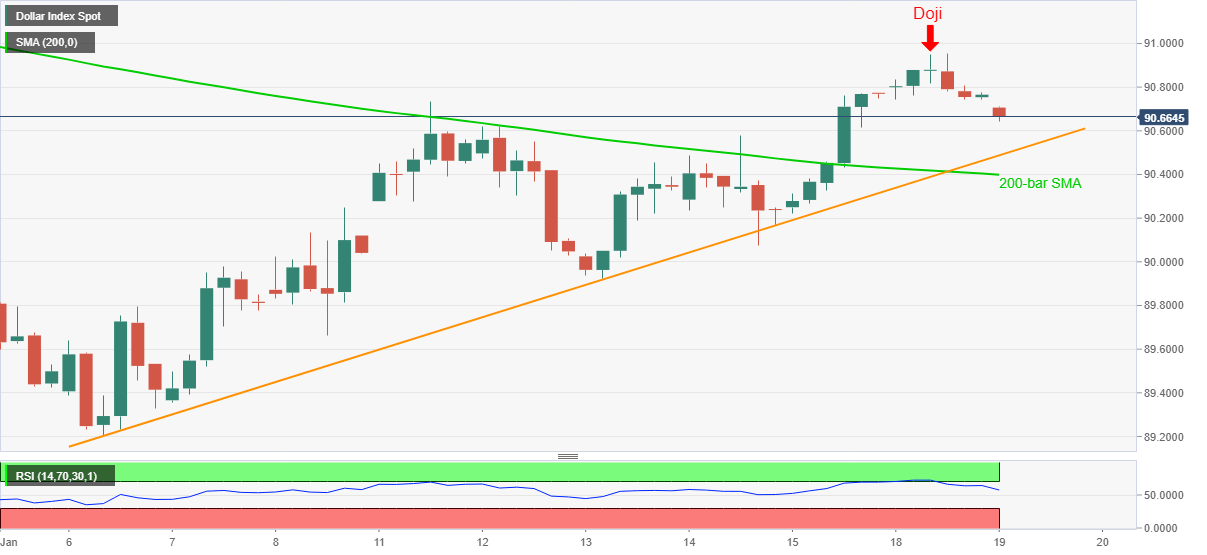

- Monday’s Doji at multi-day top, overbought RSI favor further consolidation of gains.

- 200-bar SMA adds to the downside filters, bulls need a clear break of December 07 top for fresh entries.

US dollar index (DXY) remains on the back foot around 90.68, down 0.10% intraday, during early Tuesday.

The greenback gauge versus major currencies surged to the highest since December 21 the previous day before taking a U-turn from 90.95. In doing so, the index prints Doji candlestick formation suggesting a reversal in the established move at the multi-day high. The signals from the candlestick pattern gained extra strength amid overbought RSI conditions.

As a result, DXY dropped afterward and is currently targeting an upward sloping trend line from January 06, at 90.48.

It should, however, be noted that the gauge’s downside past-90.48 will need to break the 200-bar SMA level of 90.39 and the 90.00 threshold to convince the bears.

Alternatively, a clear run-up beyond the latest high of 90.95 won’t be enough to recall the DXY buyers as the 91.00 threshold and high marked on December 07, around 91.25 become extra hurdles to watch.

Overall, DXY is likely to witness a pullback during the short-term uptrend. However, risk-on mood and expectations of further optimism may challenge the bulls should the quote ignores immediate supports.

Read: S&P 500 Futures gain half a percent towards 3,800 as markets brace for Biden welcome

DXY four-hour chart

Trend: Further weakness expected