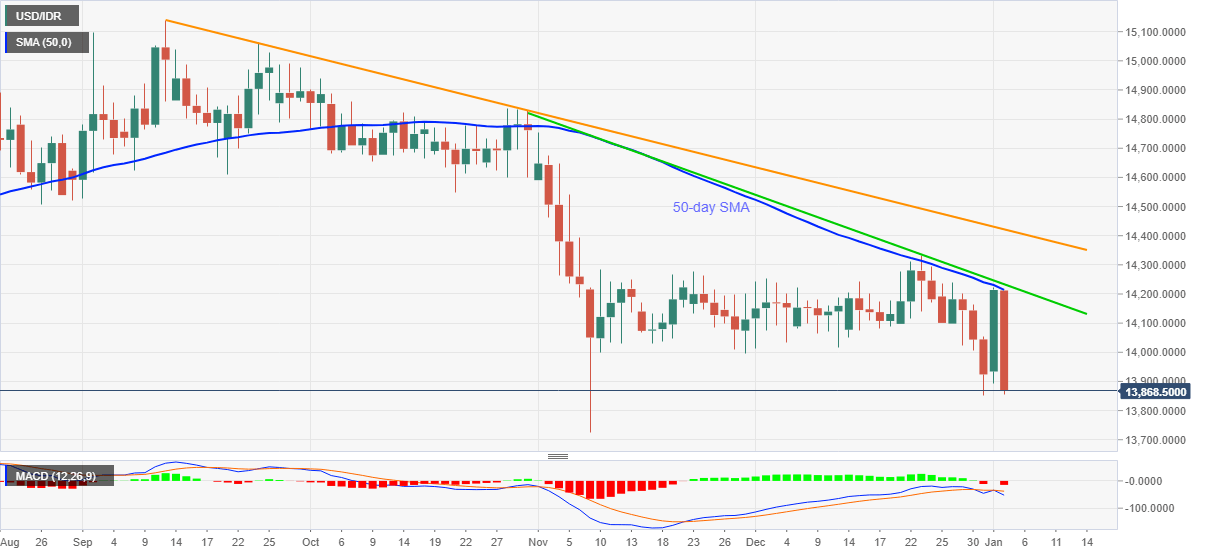

USD/IDR Price News: Indonesian rupiah keeps gains from 50-day SMA on upbeat inflation

- USD/IDR remains pressured after Indonesia inflation data for December.

- Indonesian Inflation rose past-1.61% YoY, 0.37% MoM forecasts.

- Two-month-old falling trend line adds to the upside barriers.

USD/IDR wavers around 13,870, down 2.40% intraday, after Indonesia, reports December’s Inflation numbers during early Monday.

As per the data, headlines Inflation YoY crossed 1.61% forecast to print 1.68% figures whereas MoM details also crossed 0.37% expectations to 0.45%. Though Core Inflation eased below 1.7% market consensus and 1.67% prior to 1.6% YoY.

Considering the upbeat fundamentals and the quote’s U-turn from 50-day SMA, not to forget a falling trend line from October 30, USD/IDR is likely to stay depressed.

However, the December low near 13,850 becomes necessary for the bears to eye the previous year’s low of 13,217. During the downside, November’s bottom around 13,725 can offer intermediate moves.

Meanwhile, an upside clearance of 50-day SMA, at 14,214 now, needs validation from the aforementioned resistance line, currently around 14,235, to challenge a downward sloping trend line from September 11 near 14,420.

It should, however, be noted that a daily closing beyond 14,420 will set the tone for fresh upside momentum towards October’s top of 14,835.50.

USD/IDR daily chart

Trend: Bearish