GBP/USD Price Analysis: Bounces back to 1.3300 mark; remains vulnerable

- GBP/USD came under intense selling pressure and broke through important support levels.

- Oversold conditions on hourly charts helped ease the bearish pressure near the 1.3225 area.

- The near-term technical set-up might have already shifted back in favour of bearish traders.

The GBP/USD pair witnessed some heavy selling on the first day of a new trading week and retreated further from the highest level since April, around the 1.3540 region touched on Friday. Fading hopes for a last-minute Brexit deal took its toll on the British pound, which, in turn, was seen as a key factor exerting pressure on the major.

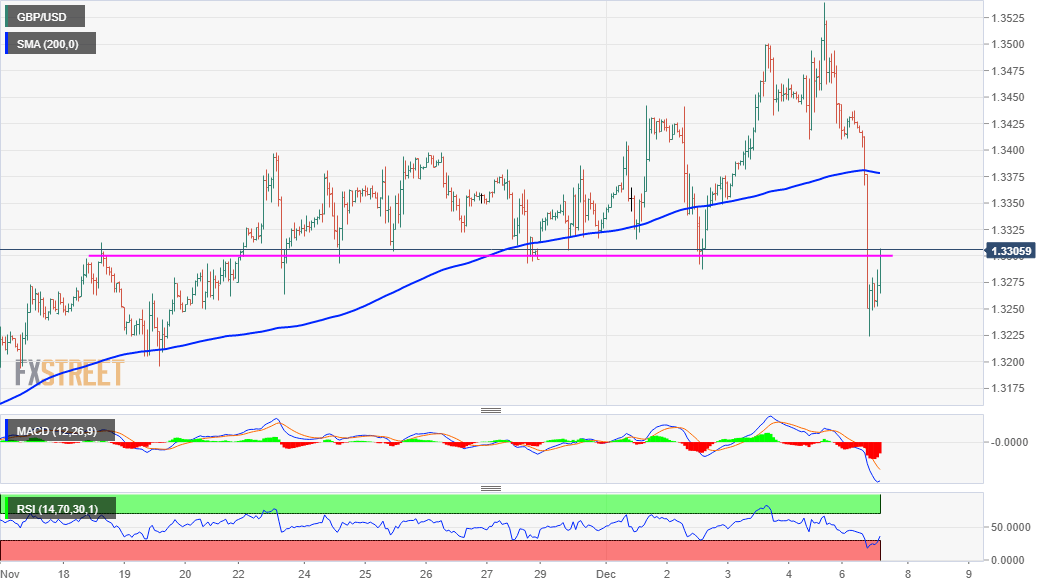

From a technical perspective, a sustained break below 200-hour SMA, around the 1.3380-75 region, was seen as a key trigger for intraday bearish traders. A subsequent breakthrough the 23.6% Fibonacci level of the 1.2676-1.3540 strong move up aggravated the bearish pressure and dragged the GBP/USD pair to over two-week lows.

The steep intraday decline took along some short-term trading stops near the 1.3300-1.3290 strong horizontal support, which might have already set the stage for an extension of the sharp corrective slide. That said, extremely oversold conditions helped limit the downside, rather assisted the GBP/USD pair to find some support near the 1.3225 region.

The GBP/USD pair has now bounced back to the 1.3300 neighbourhood, though any further recovery might be seen as a selling opportunity and runs the risk of fizzling out quickly near the 1.3330 region (23.6% Fibo. level).

On the downside, the intraday swing lows, around the 1.3225 zone – nearing the 38.2% Fibo. level – now becomes immediate support to defend. Some follow-through selling should turn the GBP/USD pair vulnerable to weaken further below the 1.3200 mark, possibly towards testing the next major support near the 1.3110-05 area, or 50% Fibo. level.

GBP/USD 1-hourly chart

Technical levels to watch