GBP/USD Price Analysis: 1.2445/50 resistance confluence regains market attention

- GBP/USD seesaws near three-day high after the previous day’s notable rise.

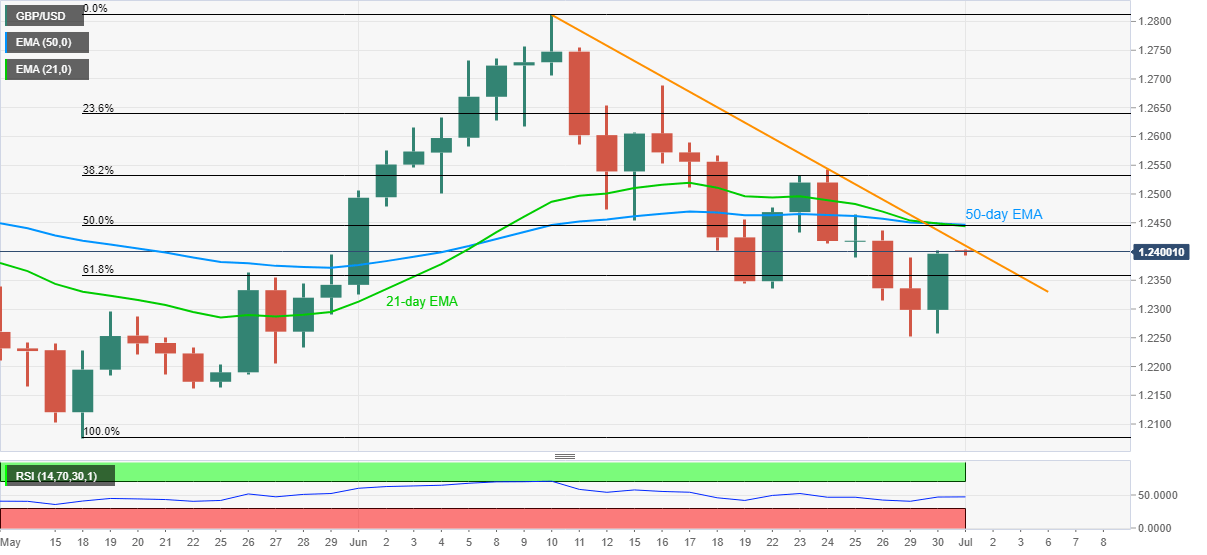

- The quote keeps an upside break of 61.8% Fibonacci retracement to confront a three-week-old ascending trend line.

- A confluence of 50% Fibonacci retracement, 21-day EMA and 50-day EMA becomes a tough nut to crack for buyers.

- Sellers will wait for entries unless breaking 1.2250.

GBP/USD bulls catch a breather around the weekly top while trading near 1.2400 amid the early Asian session on Wednesday. The Cable printed heavy gains to cross 61.8% Fibonacci retracement of May-June upside the previous day.

Considering the quote’s sustained break above the key Fibonacci retracement, it becomes capable to overcome the immediate resistance line, at 1.2410 now. However, the 1.2445/50 area comprising 50% Fibonacci retracement and key EMAs will challenge the pair’s further upside.

In a case where the bulls dominate past-1.2445/50, 1.2545 and 1.2690 could offer intermediate halts ahead of fueling the quote towards June month’s top surrounding 1.2815.

Meanwhile, a daily closing below 1.2358, comprising 61.8% of Fibonacci retracement, could divert the sellers towards attacking Monday’s low near 1.2250.

Should the sellers succeed in breaking 1.2250 support, May 22 bottom close to 1.2160 might act as a buffer before dragging the move towards the May 18 low of 1.2075.

GBP/USD daily chart

Trend: Pullback expected