Back

9 Jun 2020

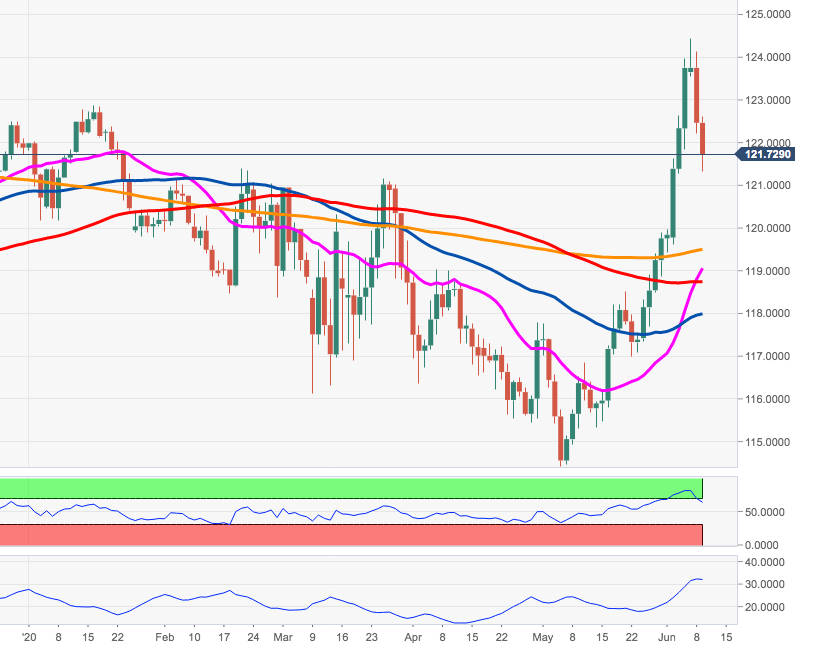

EUR/JPY Price Analysis: Leg lower now targets 121.00

- The selling pressure accelerates in EUR/JPY following 2020 highs.

- Immediately to the downside emerges the March tops around 121.00.

EUR/JPY is navigating multi-day lows in the mid-121.00s at the time of writing, coming under selling pressure after recording fresh YTD tops in the 124.40/45 band at the end of last week.

The cross has abandoned the overbought territory (as per the daily RSI) amidst increasing selling pressure and now targets the 121.00 neighbourhood, coincident with March’s peak.

On the broader picture, will above the 200-day SMA, today at 119.41, the outlook is expected to remain positive.

EUR/JPY daily chart