Natural Gas Price: Further downside in the pipeline

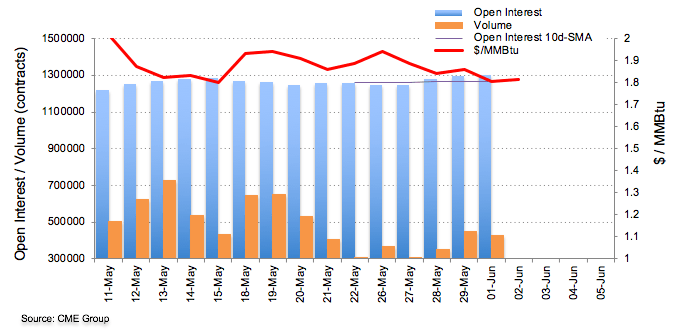

In light of advanced figures from CME Group for Natural Gas futures markets, open interest rose for the fourth consecutive session on Monday, now by nearly 2.6K contracts. Volume, instead, diminished by nearly 20.9K contracts after two builds in a row.

Natural Gas Prices Forecast

Prices of Natural Gas started the week on a negative fashion. Further downside remains on the table, however, supported by increasing open interest and erratic volume.

In fact, Natural Gas tested levels last seen in mid-April on Monday before rebounding a tad and close the session just above the $1.80 mark per MMBtu. Further downside momentum should see the $1.680 region revisited (April 16) ahead of the 2020 low at $1.574 (April 2). The potential rebound, however, carries the potential to extend to the key barrier at $2.00, although a stronger catalyst is needed to extend the move further north on a sustainable fashion.