Back

18 May 2020

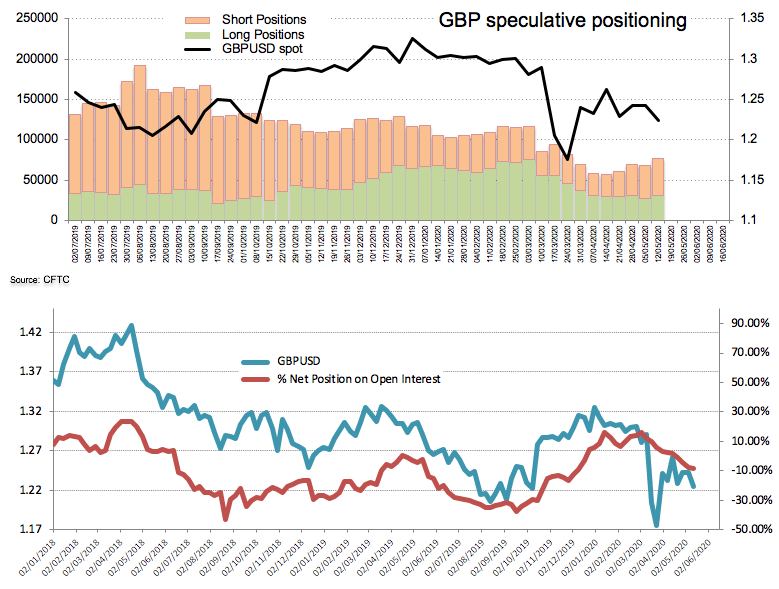

CFTC Positioning Report: GBP net shorts in multi-month highs

These are the main highlights of the CFTC Positioning Report for the week ended on May 12th:

- Speculators kept adding gross shorts to their already negative positioning in the sterling for the fourth consecutive week, pushing net shorts to the highest level since early December 2019. Uncertainty around the impact of the coronavirus on the UK economy, UK-EU trade jitters in combination with Brexit woes and prospects of further easing by the Bank of England have been sustaining the sour sentiment around the quid during past weeks.

- EUR net longs climbed to 2-week highs on the back of positive headlines regarding the re-opening of some economies in the euro area as well as ebbing concerns on the advance of the COVID-19 in the region. In addition, the solid position of the region’s current account keeps acting as a decent contention for occasional bearish moves.

- Net longs in the dollar also clinched multi-week highs bolstered by bouts of risk aversion and despite the huge stimulus programme currently running in the US economy.