Back

6 May 2020

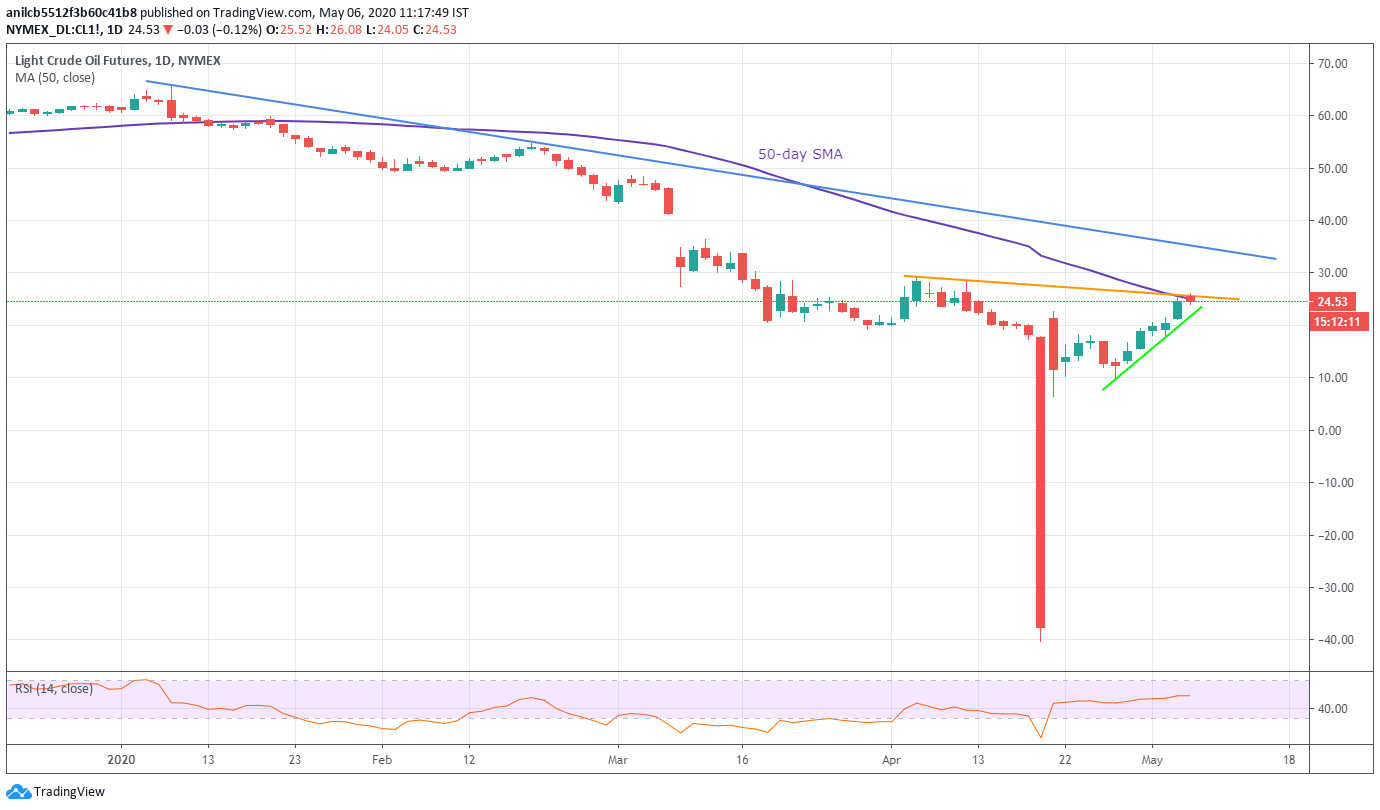

Oil Price Update: WTI retreats from monthly resistance line, 50-day SMA to sub-$25 area

- WTI pulls back from the monthly top amid failures to cross the key resistances.

- Bulls keep eyes on the yearly resistance line.

- Sellers will take entries below the one-week-old rising trend line.

WTI Futures for June steps back from the monthly top while declining to $24.60 on NYMEX amid the early Wednesday’s trading.

In doing so, the oil benchmark takes a U-turn from 50-day SMA and a falling trend line from April 03.

As a result, a weekly support line, currently around $21.00, gains the sellers’ attention for fresh entries.

Alternatively, an upside clearance of $25.10 resistance confluence could propel the quote further north towards the yearly resistance line, at $35.50 now.

However, April month high near $29.15 and $30.00 round-figure can entertain buyers between $25.10 and $35.50.

WTI daily chart

Trend: Pullback expected