Back

4 May 2020

USD/CHF Asia Price Forecast: Greenback starts the week upbeat vs. Swiss franc

- USD/CHF starts Monday with a 50-pip boost.

- The 0.9670 resistance can be the next hurdle on the upside.

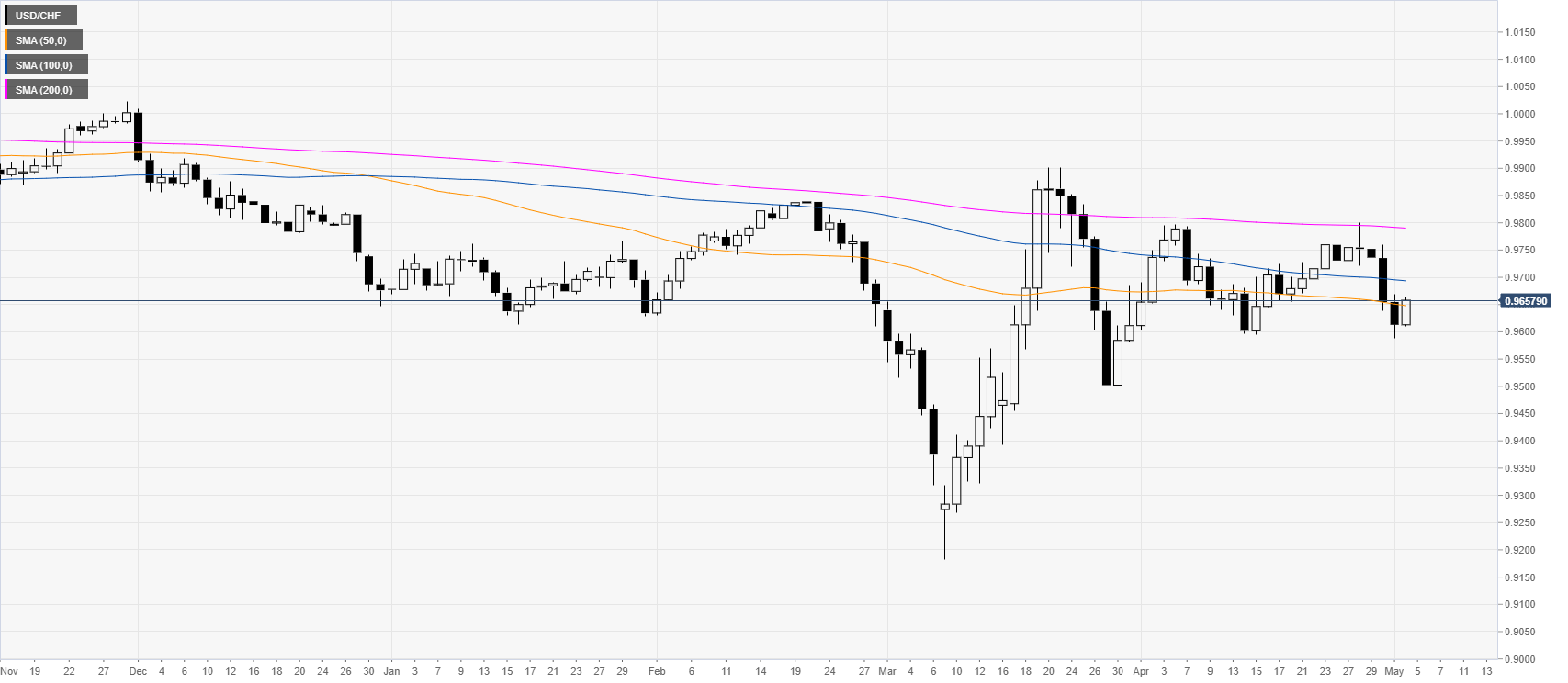

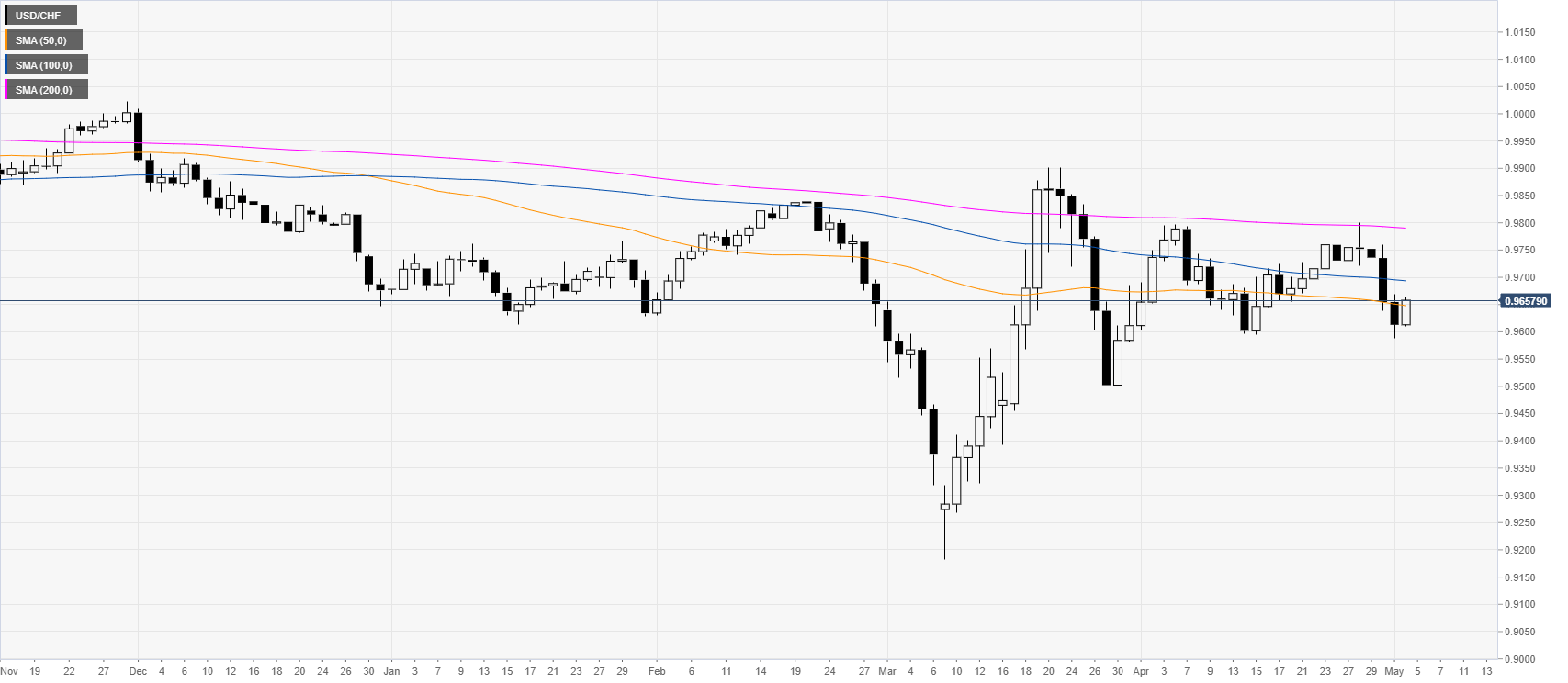

USD/CHF daily chart

USD/CHF is trading below the 100 and 200 SMAs on the four-hour chart suggesting a bearish bias. However dollar/swiss is also trading within familiar ranges as the market found some support near April’s lows.

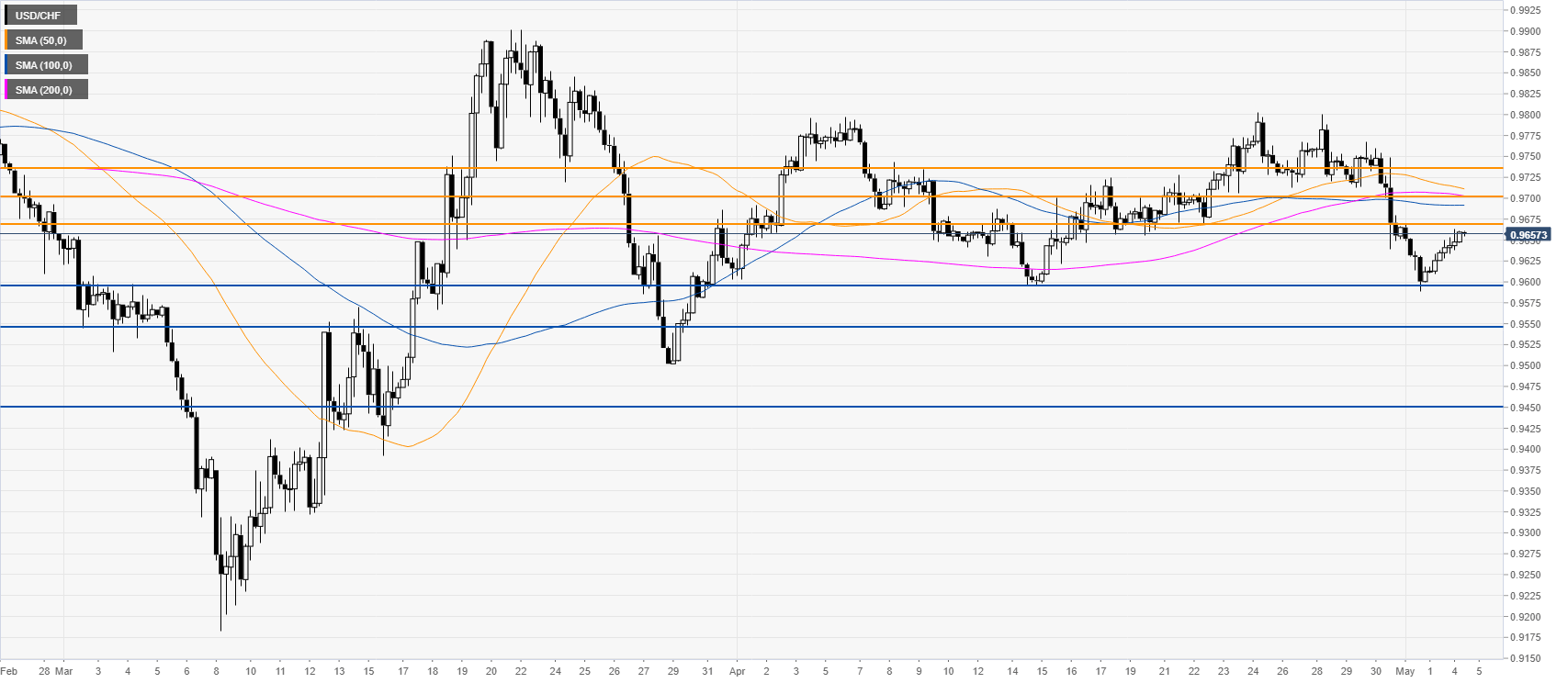

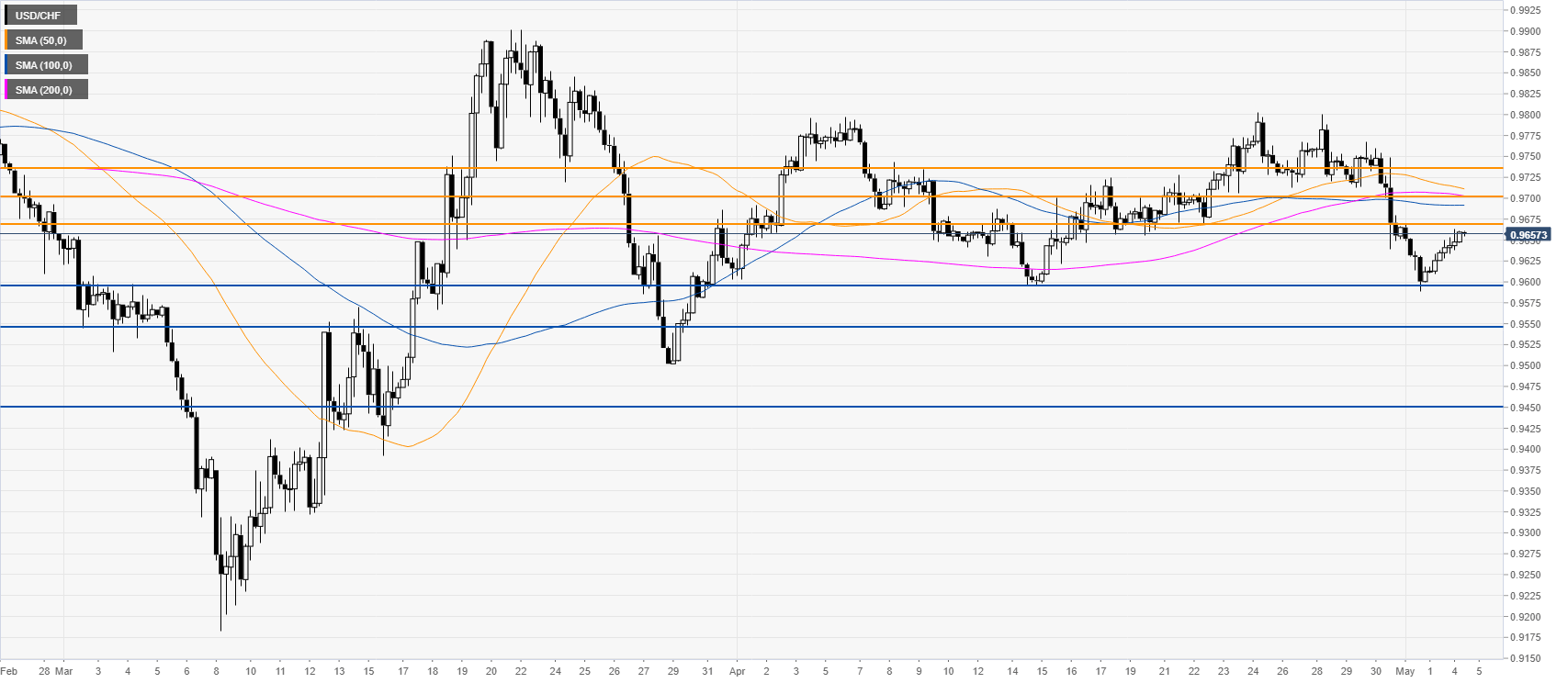

USD/CHF four-hour chart

The spot is bouncing from the 0.9600 level however still trading below the main SMAs on the four-hour chart. The 0.9670 resistance is the next hurdle if bulls want to capitalize on the Monday boost. A failure below the above-mentioned level can lead to a retest of the 0.9600 figure in the medium-term.

Additional key levels