Back

4 May 2020

US Dollar Index Asia Price Forecast: DXY gaps up, trades near 99.60 resistance

- US dollar index (DXY) gaps up this Monday but remains limited by tough 99.60 resistance.

- DXY is still trading within familiar ranges with little directional bias.

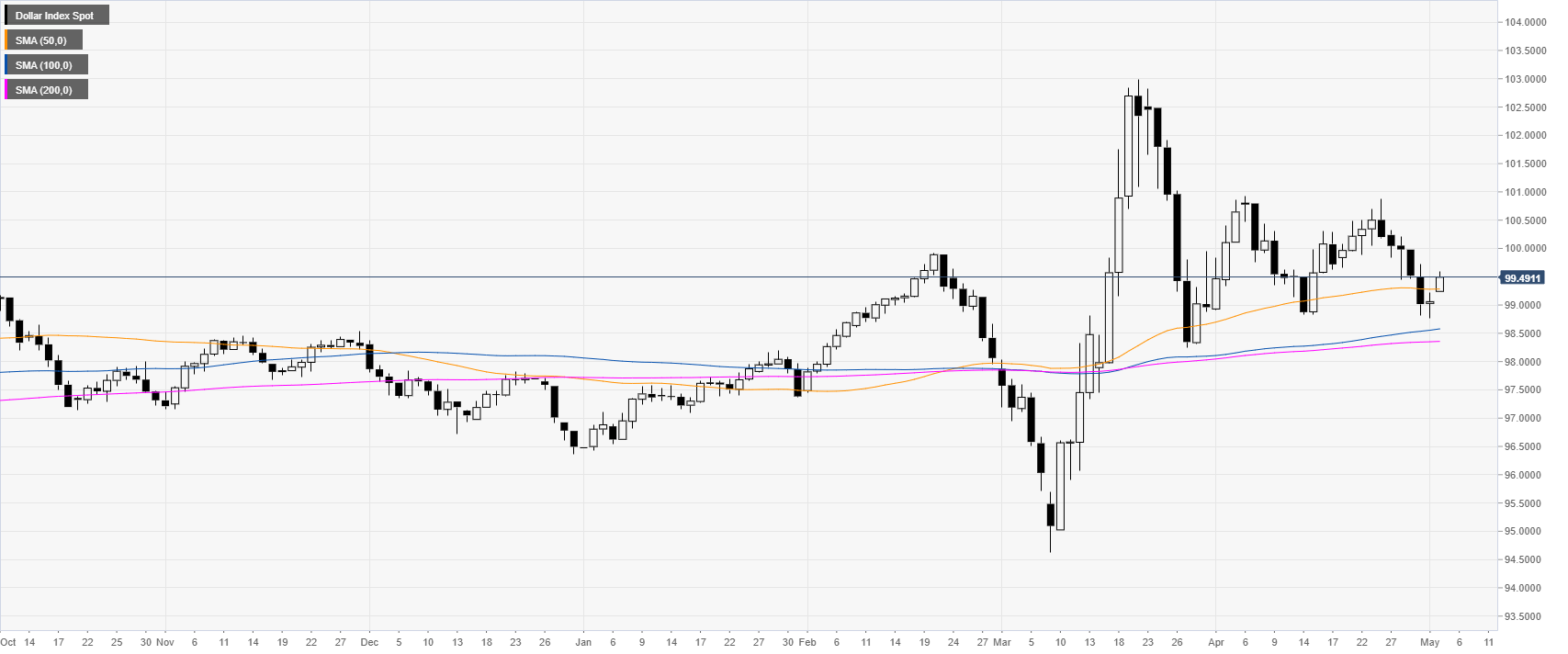

DXY daily chart

The US Dollar Index (DXY) gapped up this Monday above the 50 SMA on the daily chart. However, the index remains trapped withing familiar ranges while below the April’s highs.

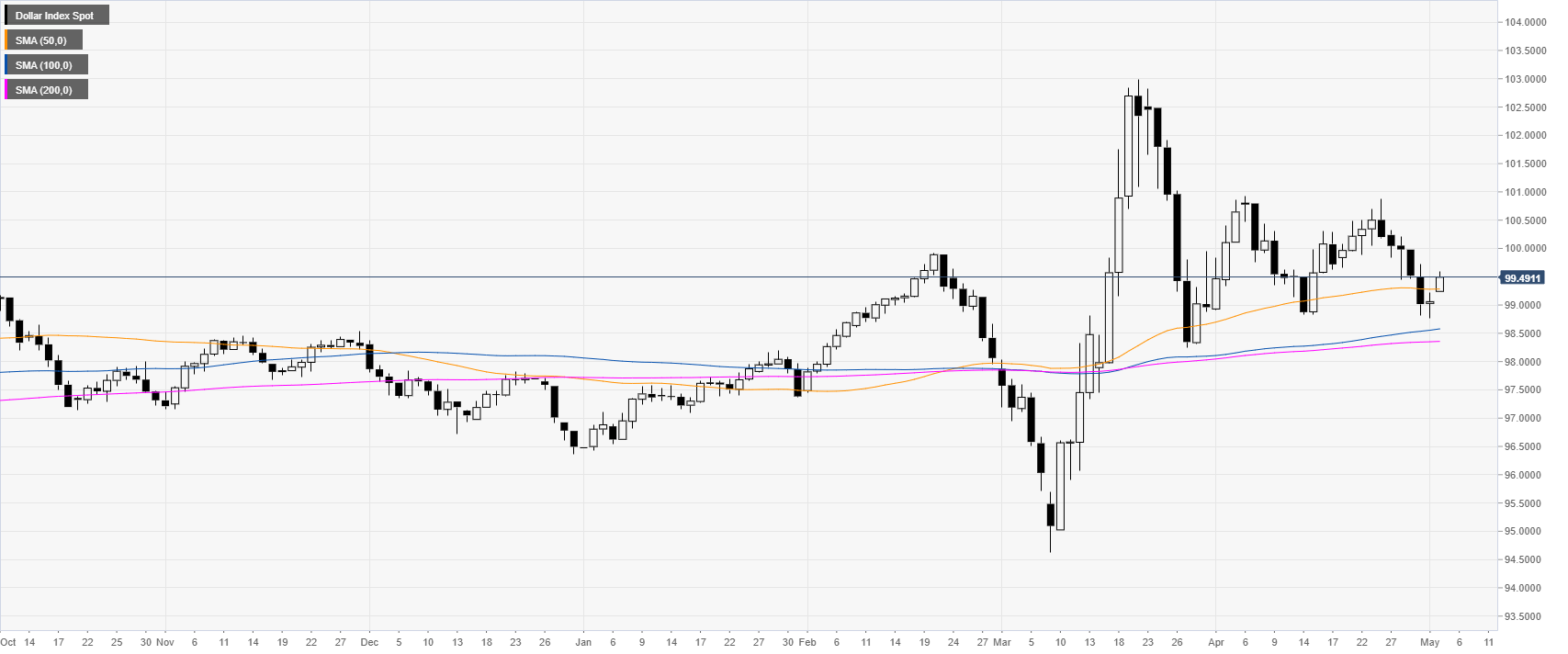

DXY daily chart

Although DXY had an upbeat start to the week the greenback is still trading between its main SMAs on the four-hour chart and below the 99.60 resistance. If sellers come back they will likely be looking for a break below the 99.30 support level en route towards the 98.90 and 98.20 price levels. Alternatively, a daily close above the 99.60 can attract further buying interest for a retest of the 100.00 figure in the medium-term.

Additional key levels