Back

25 Mar 2020

S&P 500 Price Analysis: US stocks cling to gains, challenge 2500 mark

- S&P 500 is bouncing off 37-month lows and is challenging the 2500 level.

- Investors are cheering that the Coronavirus relief bill has been passed.

- This Monday, the Fed expanded its Quantitative Easing operation which is the largest stimulus scheme ever created.

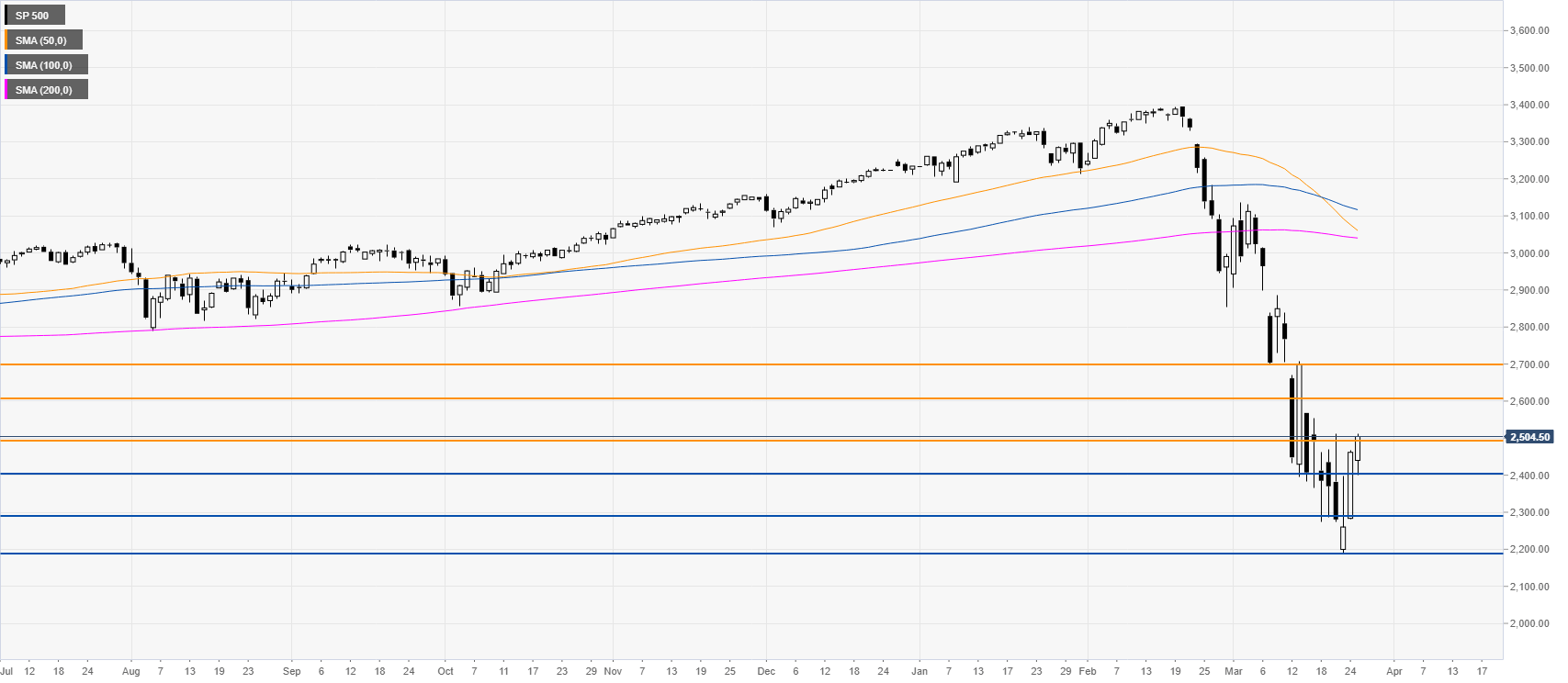

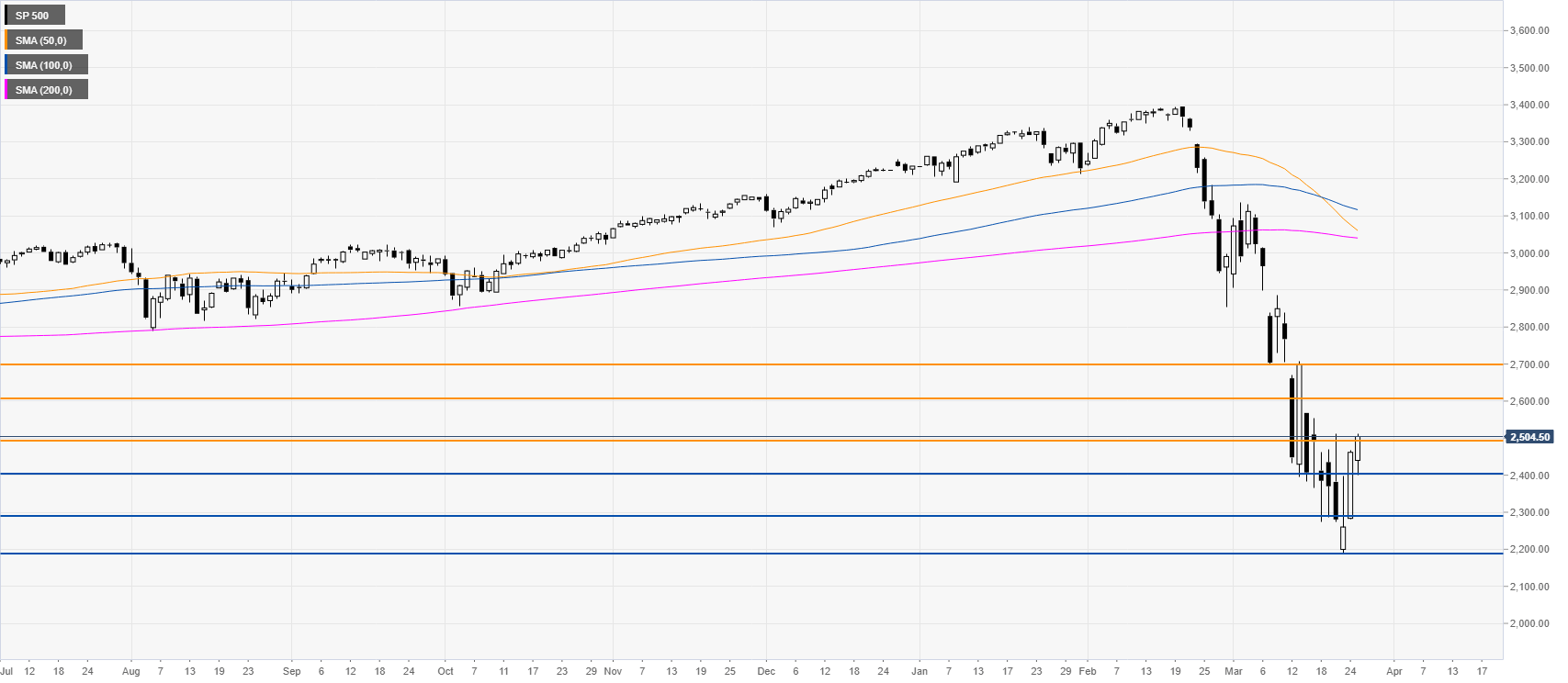

S&P 500 daily chart

Markets are reacting positively as investors find relief in the Coronavirus relief stimulus by the US government. The S&P 500 is correcting up sharply after suffering one of the most dramatic decline in history. The pullback up is extending to the upside as bulls broke above the 2500 level while resistance can be seen near the 2600 and 2700 figures on the way up. On the other hand, support is seen near the 2400 and 2300 levels. This Monday, the Fed announced the extension of its QE program to manage the damage created by the coronavirus crisis.

Additional key levels