Back

17 Mar 2020

S&P500 Price Analysis: Coronavirus crisis keeps index near one-year lows

- S&P500 consolidates losses near 2500 level.

- The level to beat for bears is the 2400 support.

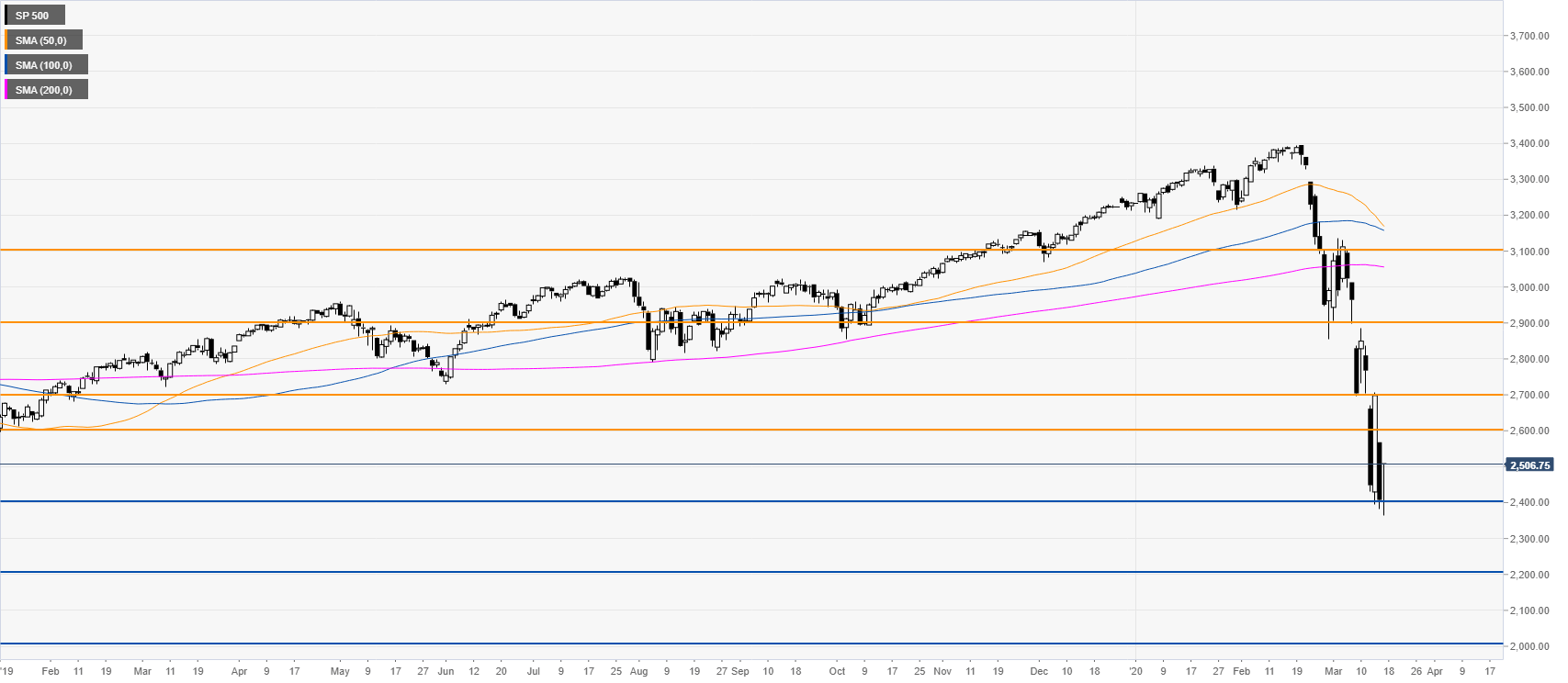

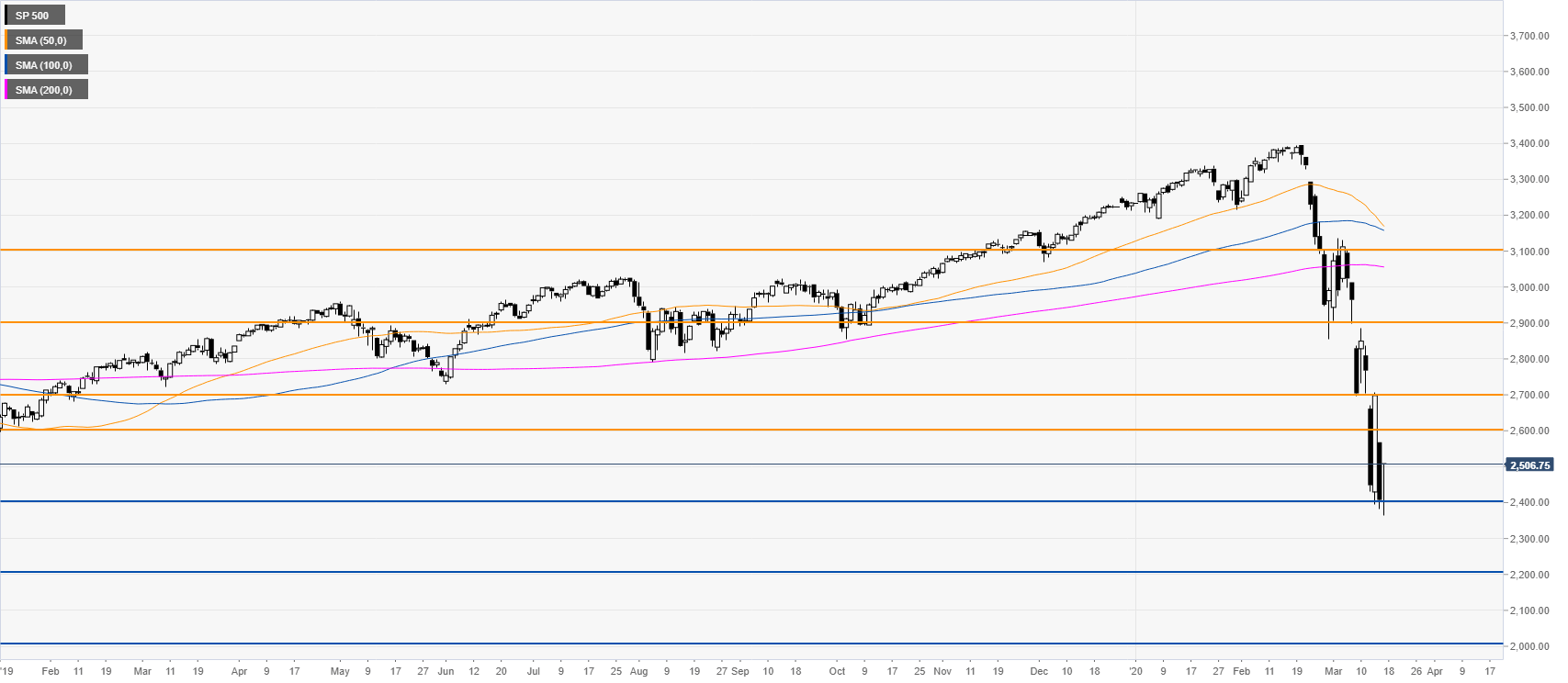

S&P500 daily chart

The market is consolidating losses below the 2600 mark and within last Friday’s range which was the largest daily advance in history. However, the S&P500 is officially in a bear market so traders might be wary of a dead cat bounce. If sellers get a daily close below the 2400 level, the index should continue to decline towards the 2200 and 2000 figures. Resistances are seen near the 2600 and 2700 levels initially.

Additional key levels