Back

9 Mar 2020

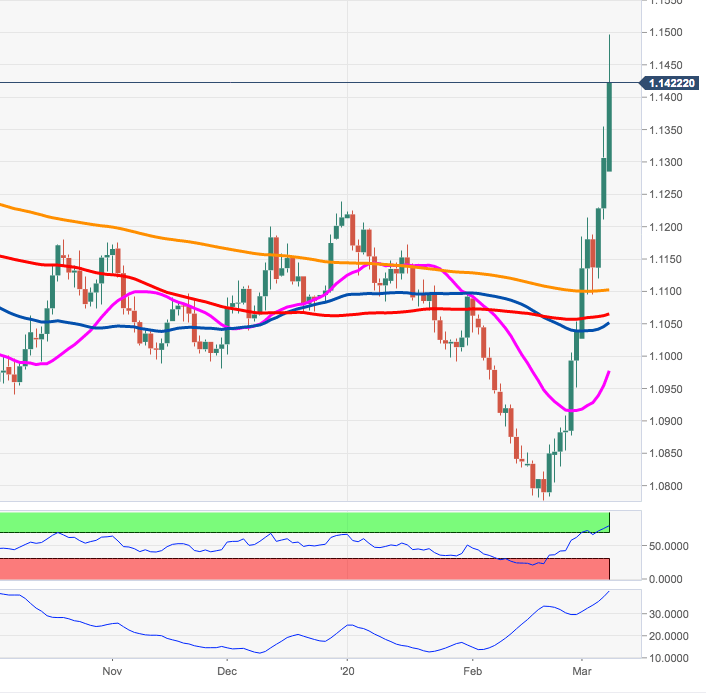

EUR/USD Price Analysis: Focus has now shifted to 1.1569

- EUR/USD’s rally falters just ahead of the 1.1500 mark on Monday.

- Bulls are now targeting the 2019 high at 1.1569.

EUR/USD has once again recorded new YTD highs, this time near the key barrier at 1.15 the figure during the Asian session.

The pair’s upside momentum picked up extra pace at the beginning of the week and advanced further north of the 200-week SMA near 1.1350.

Extreme “overbought” conditions could spark some correction lower in the near-term, with contention expected to emerge near 1.1240 (high December 31st 2019). The continuation of the buying pressure should target the 2019 high at 1.1569.

EUR/USD daily chart