Back

3 Mar 2020

USD/CAD Price Analysis: Dollar get slammed as Fed cuts rates in emergency move.

- The Fed cuts rate by 50bps in an emergency move.

- USD/CAD is pulling back down, challenging the 1.3368 support.

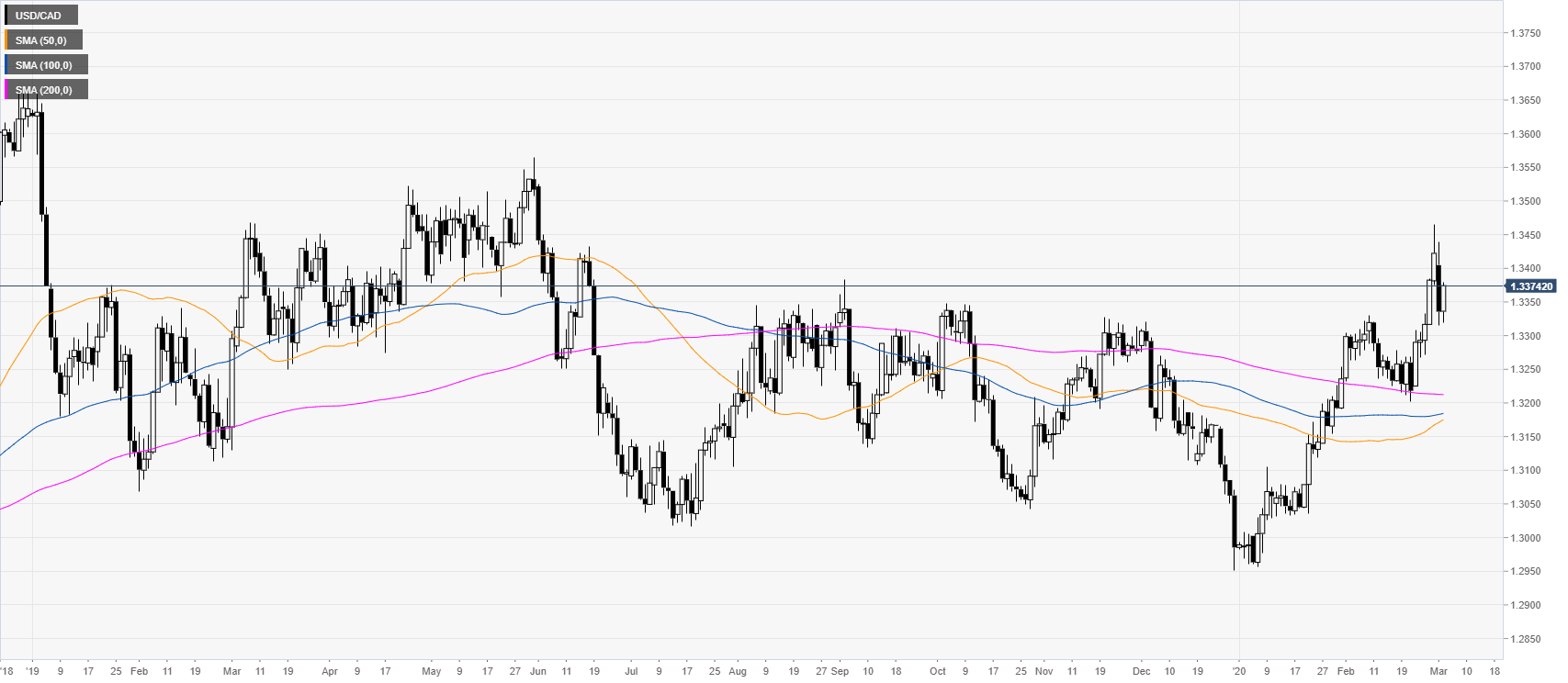

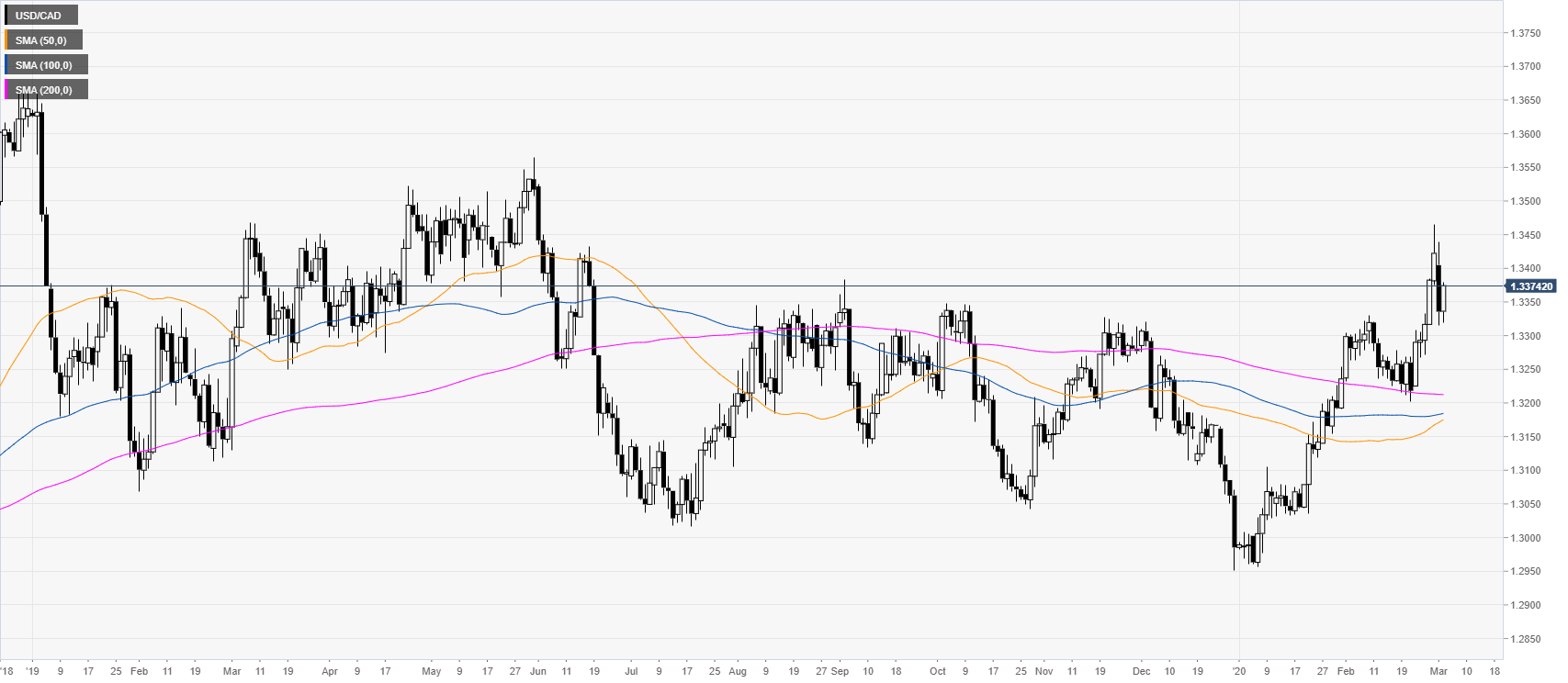

USD/CAD daily chart

USD/CAD is trading off the 2020 highs while trading above the main daily simple moving averages (SMAs) on the daily chart. The Fed cuts rate by 50bps in an emergency move.

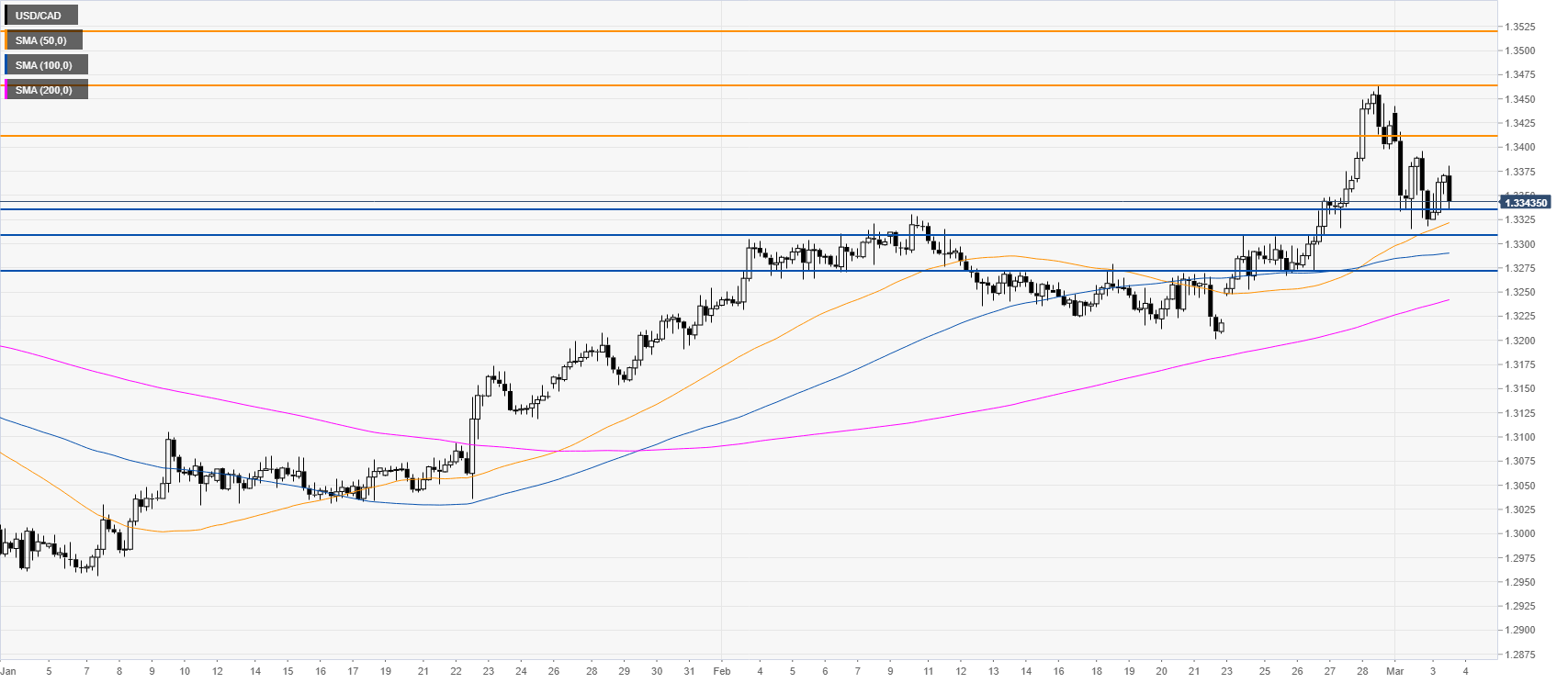

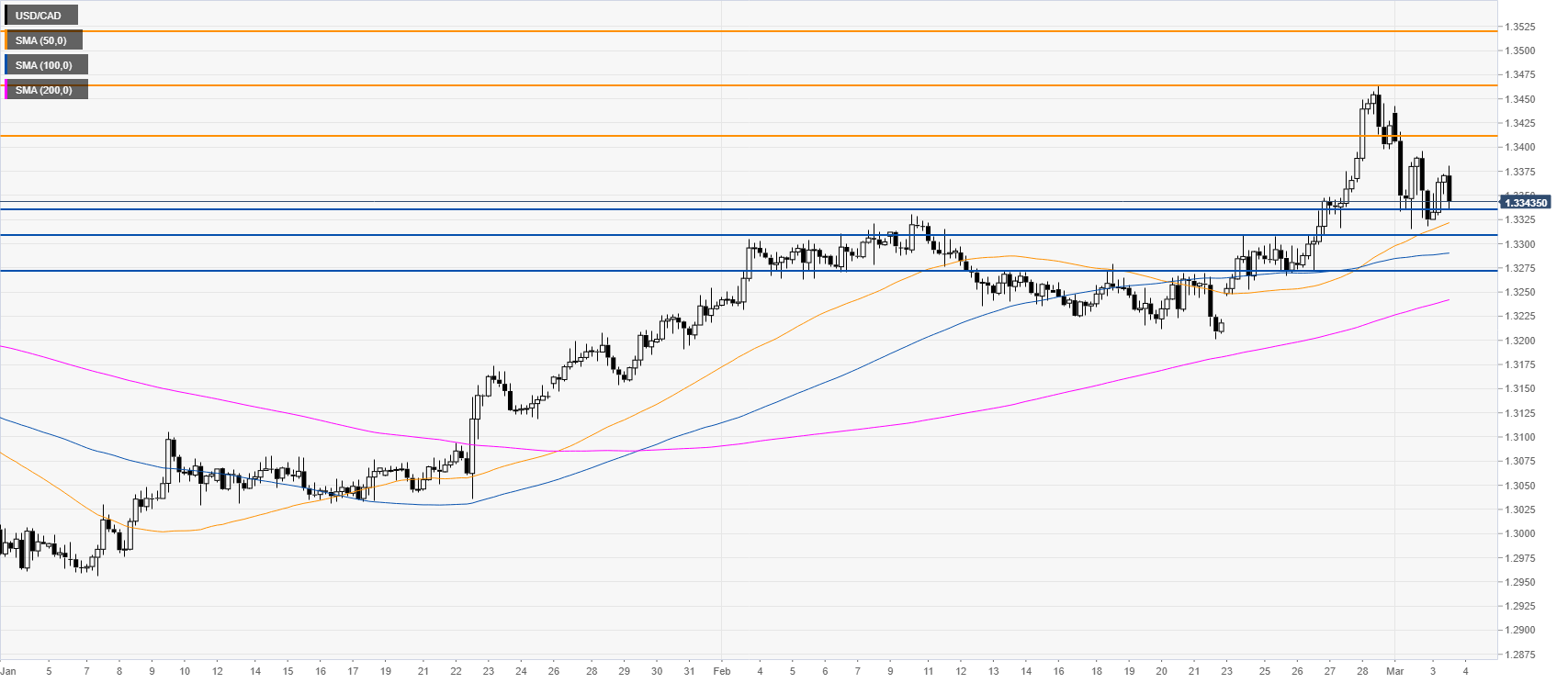

USD/CAD four-hour chart

USD/CAD is retracing down while challenging the 1.3368 support level as USD is selling off across the board. The pullback down can extend towards the 1.3310 and 1.3270 level according to the Technical Confluences Indicator. Resistance can be expected near 1.3410, 1.3465 and 1.3550 levels.

Resistance: 1.3410, 1.3465, 1.3550

Support: 1.3368, 1.3310, 1.3270

Additional key levels