Back

2 Mar 2020

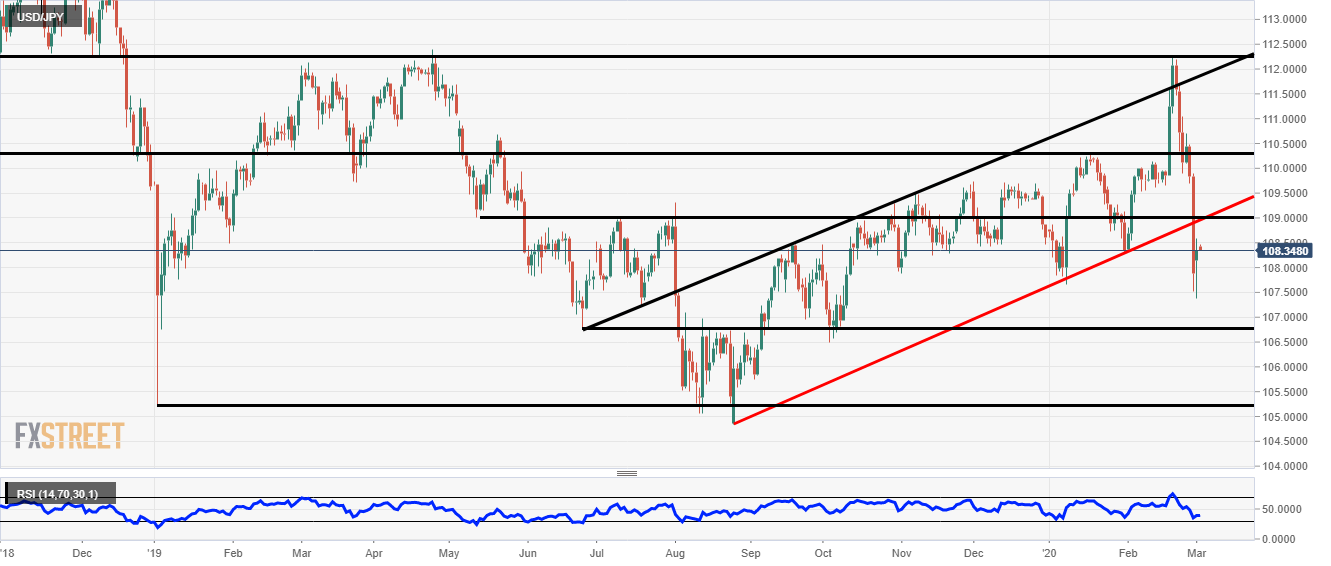

USD/JPY Price Analysis: Bounces off 107.50 but still looks bearish

- USD/JPY trades just under flat after a few sessions of extreme bearishness.

- The channel trendline could be retested and be used as resistance.

USD/JPY Daily Chart

USD/JPY has found some support at 107.50 after a heavy week of selling last week.

The red channel line on the downside has been breached and there is often a retest one a channel level is broken.

If the bearishness does continue then 106.76 could be the next support level.

Above the current price 109.00 was a very stick area for price so there could be some resistance there.

As the stock markets recover the pair found some support but the safe-haven JPY may strengthen again if the coronavirus news gets worse.

Also, there has been some weakness due to the market pricing in rate cuts from the Fed. Some analysts have noted that the price may be overdone.

Additional Levels