Back

17 Feb 2020

USD/JPY Price Analysis: Greenback in range below 110.00 figure vs. yen

- USD/JPY is starting the week trading sideways below the 110.04 resistance.

- The rising wedge formation can limit bullish advances.

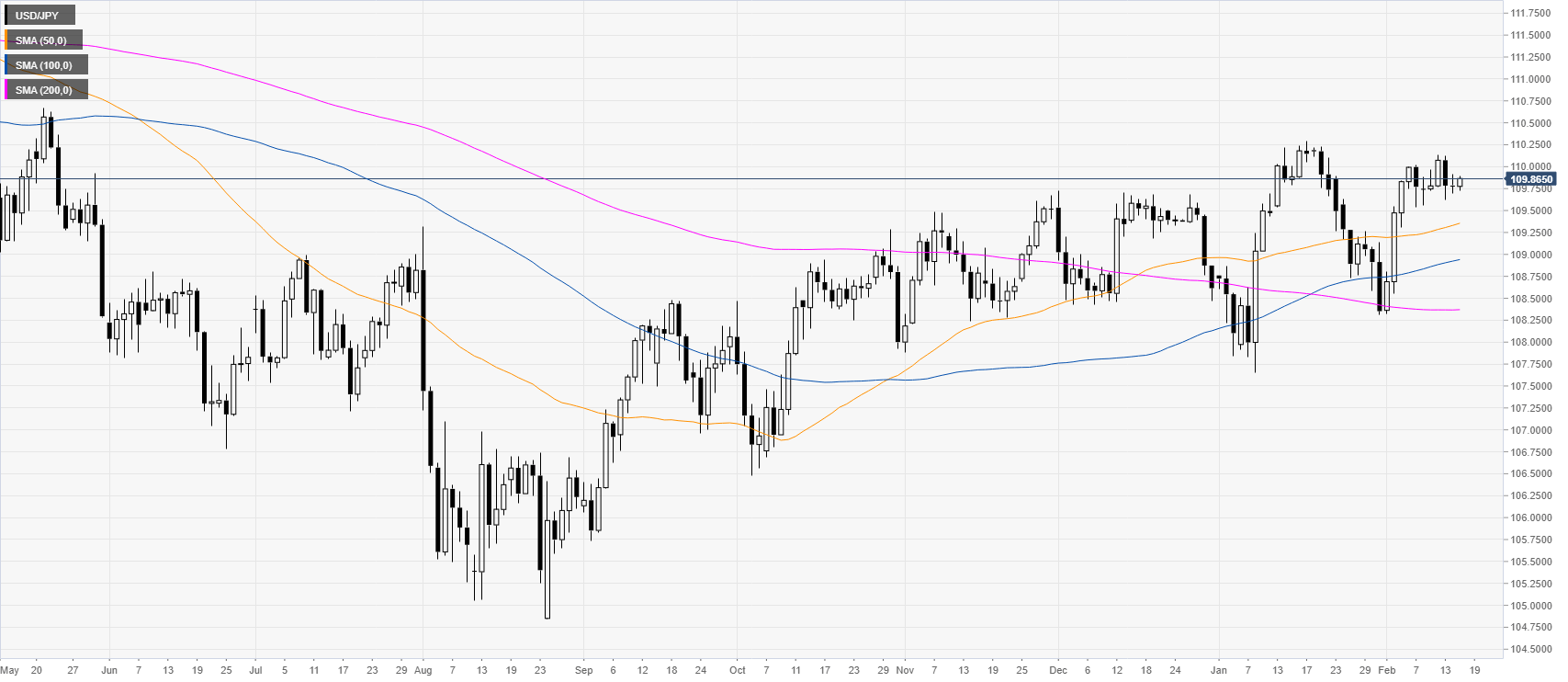

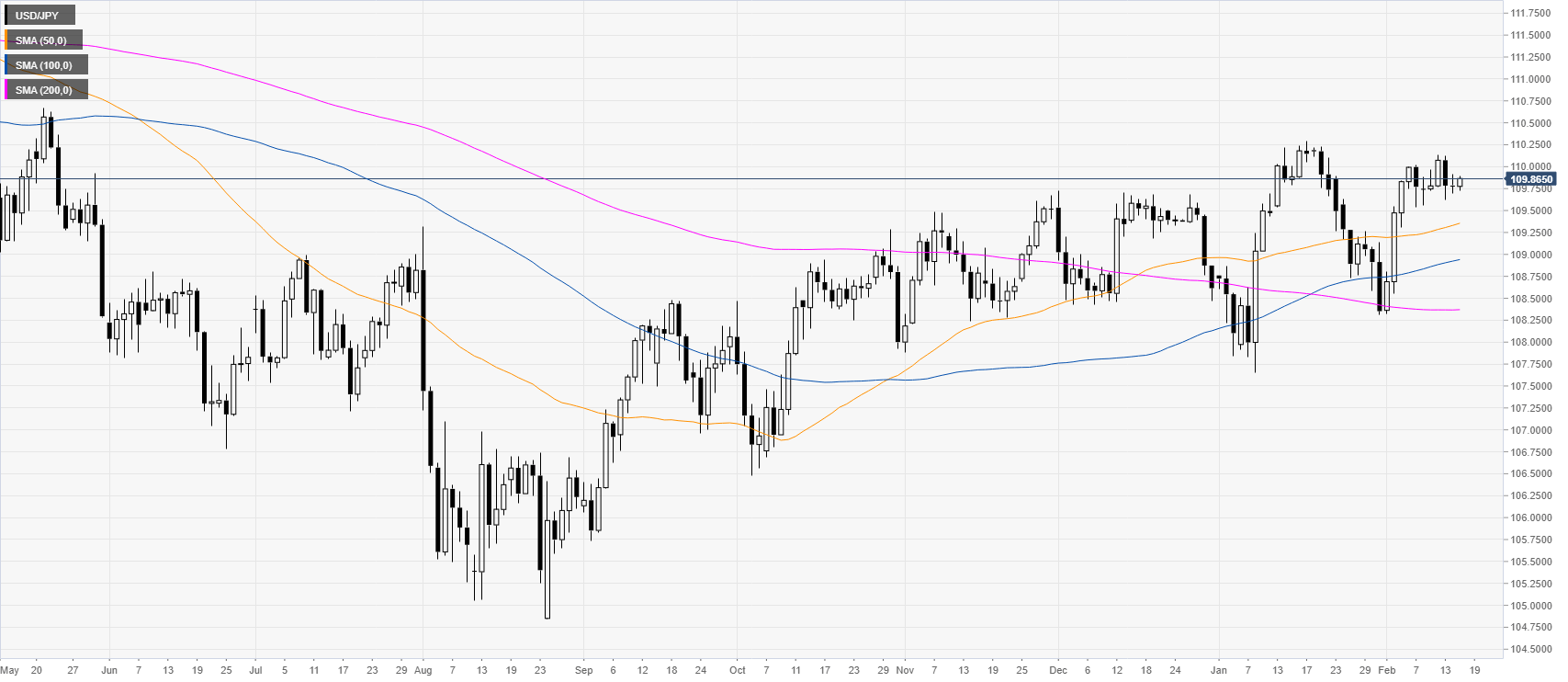

USD/JPY daily chart

USD/JPY is trading off February highs below the 110.00 figure while trading above its main daily simple moving averages (SMAs) on the daily time frame.

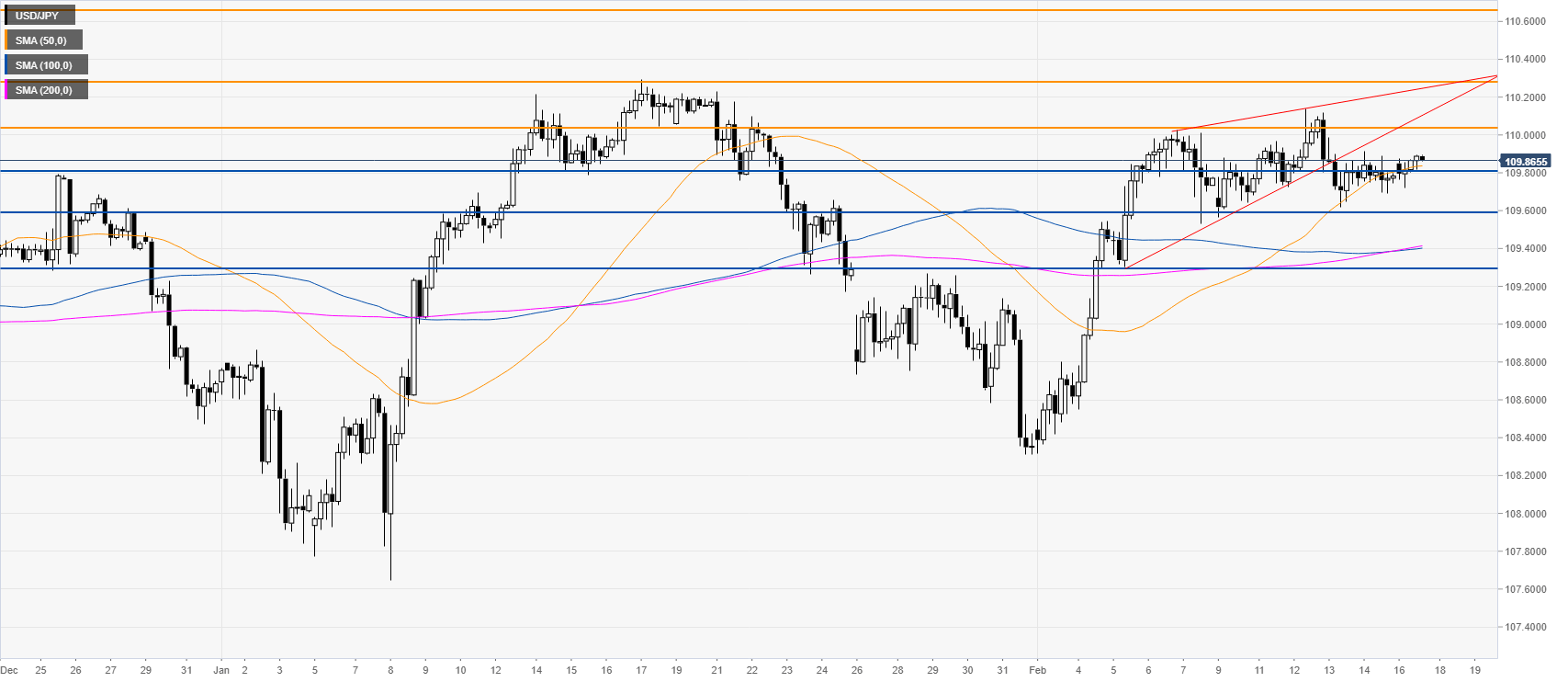

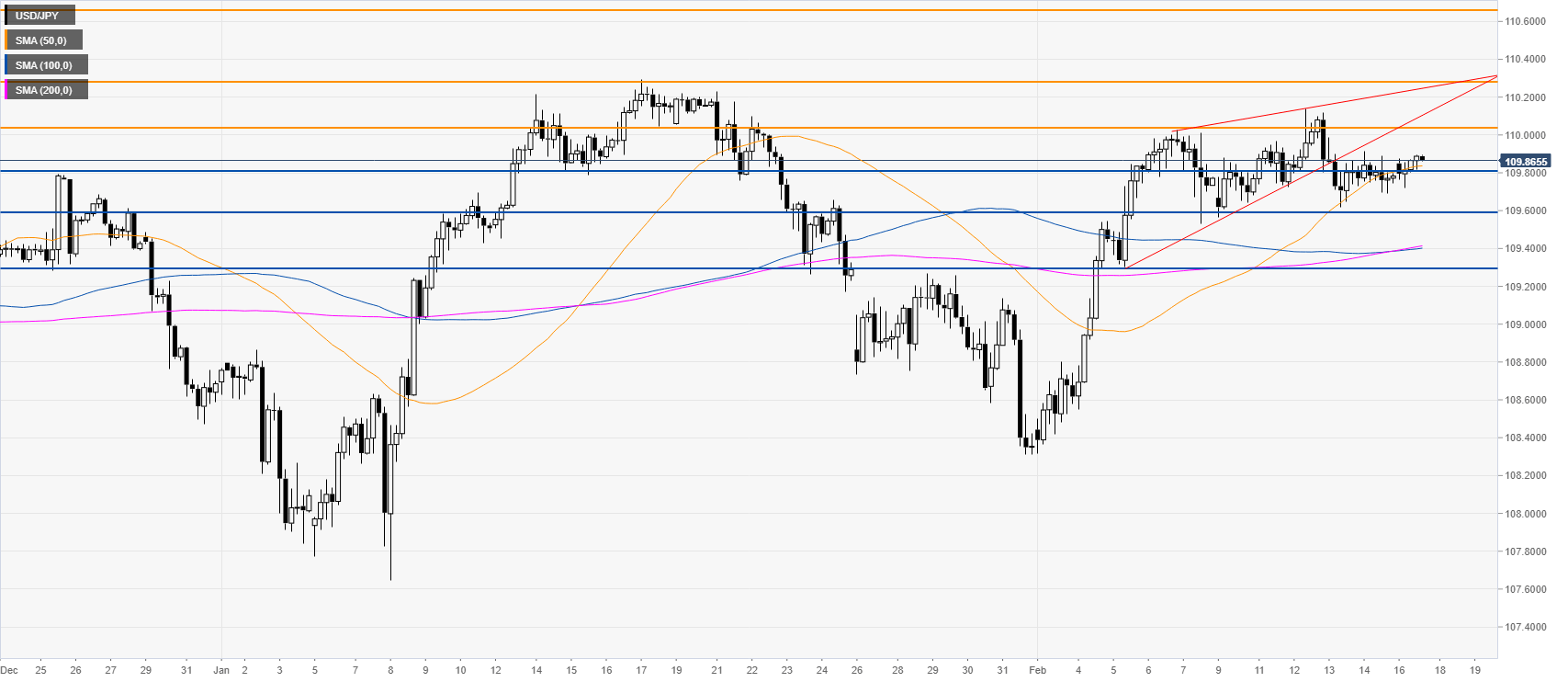

USD/JPY four-hour chart

USD/JPY broke below a rising wedge formation while above the main SMAs. The spot is trading sideways below the 110.04 resistance as bears want to break below the 109.81 support and drive the market towards the 109.58 and 109.30 levels. On the flip side, a daily close above the 110.04 resistance can invalidate the bearish scenario, according to the Technical Confluences Indicator.

Resistance: 110.04, 110.30, 110.65

Support: 109.81, 109.58, 109.30

Additional key levels