GBP/JPY Price Analysis: Weekly support line, 200-bar SMA question the bears

- GBP/JPY fails to hold the break of 61.8% Fibonacci retracement.

- The bulls stay hopeful unless the pair breaks 142.70 support confluence.

- Fresh monthly high could renew buying interest.

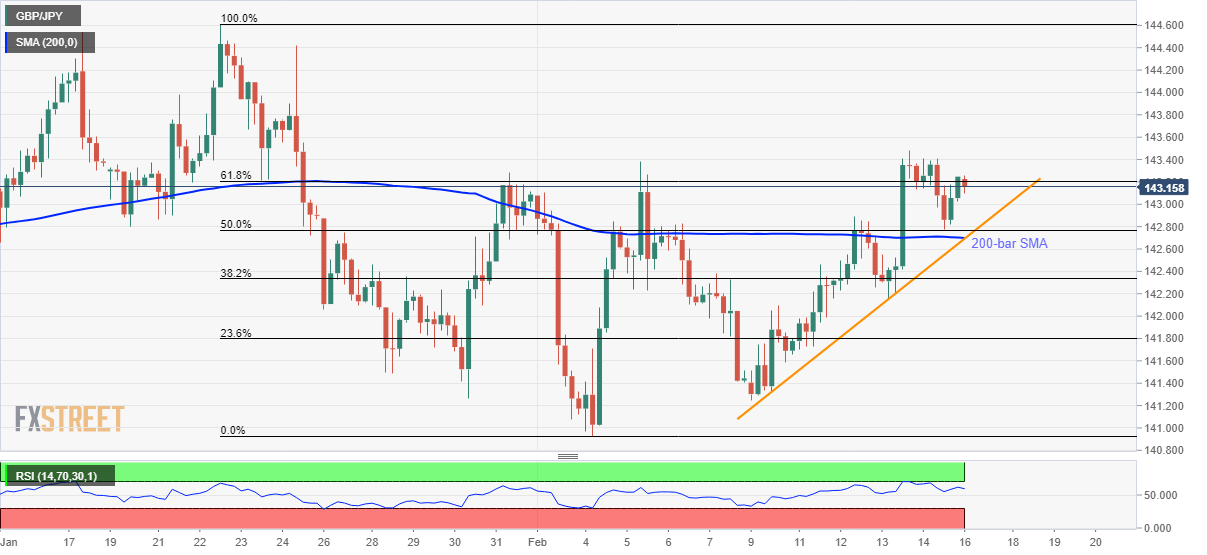

GBP/JPY weakens to 143.17 amid the initial Asian trading session on Monday. The quote recently slipped from 61.8% Fibonacci retracement of its January 22 to February 04 declines. Even so, a confluence of 200-bar SMA and an upward sloping trend line from February 10 could challenge the bears.

A lower low formation on the four-hour chart pushes the sellers to await the downside break of 142.70 support confluence while targeting 142.15 and 142.00 supports.

During the quote’s further weakness below 142.00, 141.65 and the monthly low near 140.90 could offer intermediate halts to 140.00 psychological magnet.

Alternatively, buyers will look for an entry on the break of the month’s high surrounding 143.50.

In doing so, 144.00 and late-January tops close to 144.60 will be on their radars.

GBP/JPY four-hour chart

Trend: Pullback expected