Trading the RBNZ on hold – TD Securities

Analysts at TD Securities offer a sneak peek at what to expect from Wednesday’s Reserve Bank of New Zealand’s (RBNZ) Interest Rate Decision due at 0100 GMT.

Key Quotes:

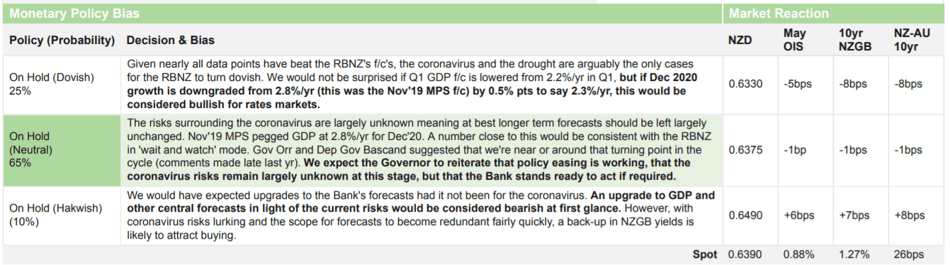

“The RBNZ is expected to keep the cash rate on hold at 1% tmrw. Data has beat RBNZ's Nov MPS f/c's - GDP @ 0.7%/q vs 0.3%/q RBNZ; CPI @ 1.9% vs 1.6% RBNZ; unemployment @ decade lows, 4% vs 4.2% RBNZ, Wage growth is @ 10yr highs; House prices are advancing; Terms of Trade/Building Permits nr record highs; Fiscal policy is on the table; Finally offshore risks (Brexit/Trade War) have receded since Nov'19.

Such beats should warrant f/c upgrades and the removal of an easing bias. However, we expect the OCR profile & other f/c's should remain largely unchanged. The coronavirus is likely to hit Q1 f/c's but it's difficult to extrapolate beyond as impacts are unknown. The Bank is likely to acknowledge the risks and stand ready to act as required.”

FXStreet Indonesian Site - new domain!

Access it at www.fxstreet-id.com