EUR/USD Price Analysis: Sluggish below immediate support-turned-resistance trendline

- EUR/USD remains under pressure near the four-month low.

- October 2019 low will add a filter to the pair’s declines below 1.0900 mark.

- Friday’s low, the short-term descending trend line will add to the nearby resistances.

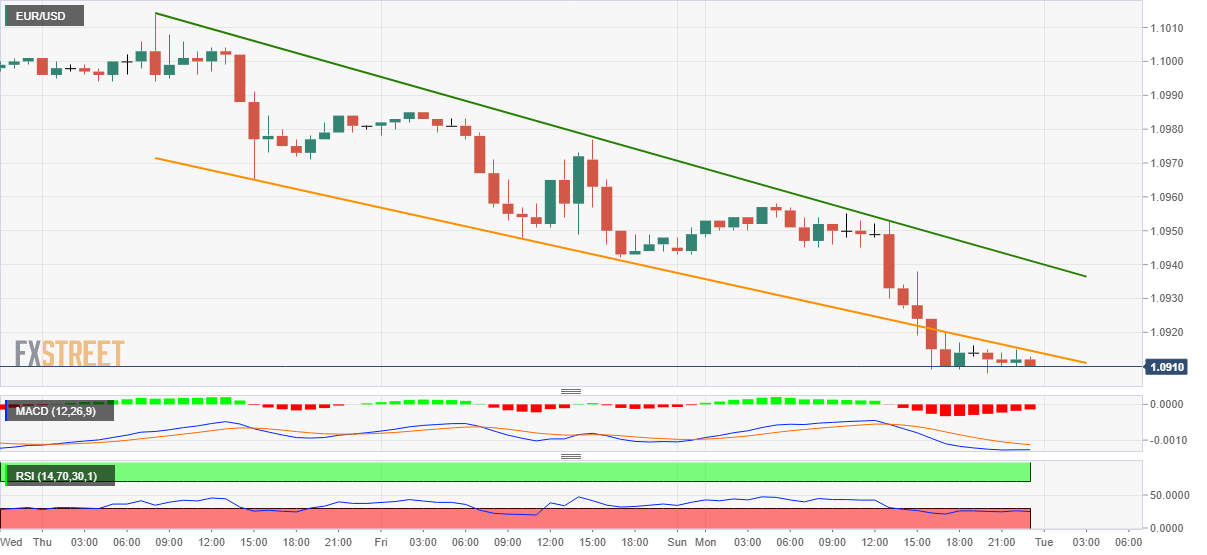

EUR/USD bears catch a breath around 1.0910 during the Asian session on Tuesday. The pair dropped to the yearly low the previous day but fails to slip beneath the 1.0900 round-figure. Even so, a three-day-old support-turned-resistance trend line limits the quote’s immediate pullback moves amid bearish MACD signals.

As a result, the sellers will keep eyes on 1.0900 mark as a trigger to take aim at October 2019 low near 1.0880.

In a case, the bears keep the helm past-1.0880, May 2017 low near 1.0840 and 1.0800 will grab the market’s attention.

Meanwhile, an upside break of the immediate resistance line, currently at 1.0915, can challenge another falling trend line resistance, also including Friday’s low, around 1.0940/45.

Even if the bulls manage to cross 1.0945 mark, their dominance remains doubtful unless breaking the January’s monthly top near 1.1100.

EUR/USD hourly chart

Trend: Bearish