AUD/NZD Price Analysis: Closer to multi-month-old support trendlines on New Zealand CPI

- AUD/NZD drops to the fresh two-week low after New Zealand’s Q4 CPI beat estimates to the upside.

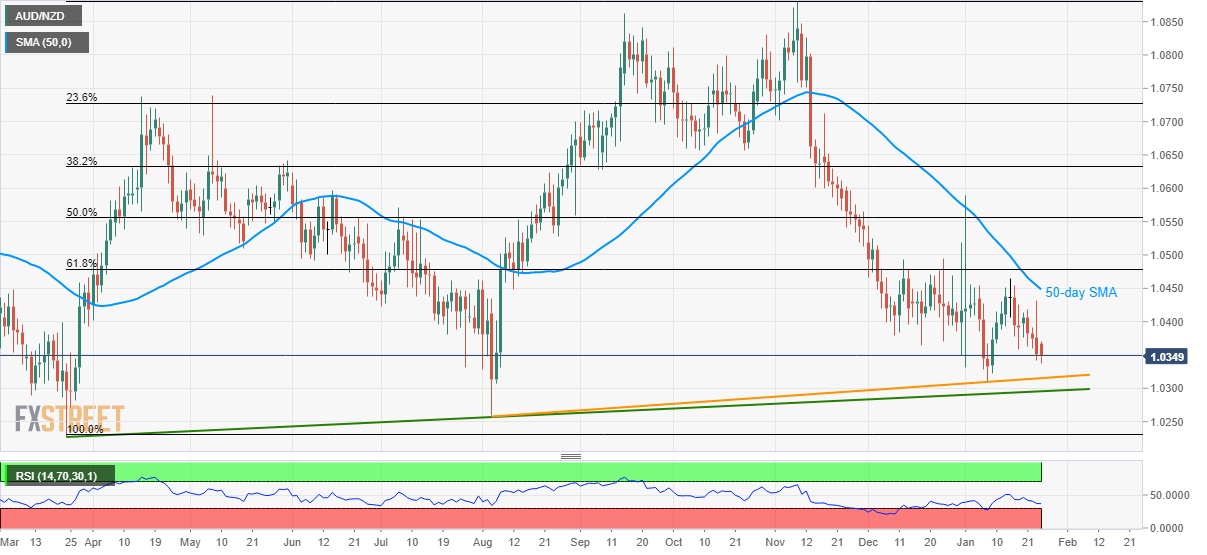

- The upward sloping trend lines since August 2019 and the one connecting lows marked from March 2019 will restrict further declines.

- 50-day SMA, 61.8% Fibonacci retracement will keep the near-term upside limited.

With the upbeat surprise from New Zealand’s fourth quarter (Q4) CPI pleasing New Zealand dollar buyers, AUD/NZD dropped to the fresh two-week low of 1.0337 after the data. The pair currently takes rounds to 1.0350 by the press time of early Asian morning on Friday.

As a result, the pair nears an ascending trend line stretched from August 2019, at 1.0315 now, as well as another support line connecting lows marked from March 2019, at 1.0295.

While the strength of the support lines is likely to restrict AUD/NZD declines below 1.0295, bears can target 1.0260 and 1.0220 during the declines post trend lines’ breaks.

On the upside, 1.0400 and 1.0430 can offer immediate resistance to the pair ahead of a 50-day SMA level near 1.0450.

However, pair’s upside beyond 1.0450 my find it difficult to cross 61.8% Fibonacci retracement of March-November 2019 upside, at 1.0480.

AUD/NZD daily chart

Trend: Bearish