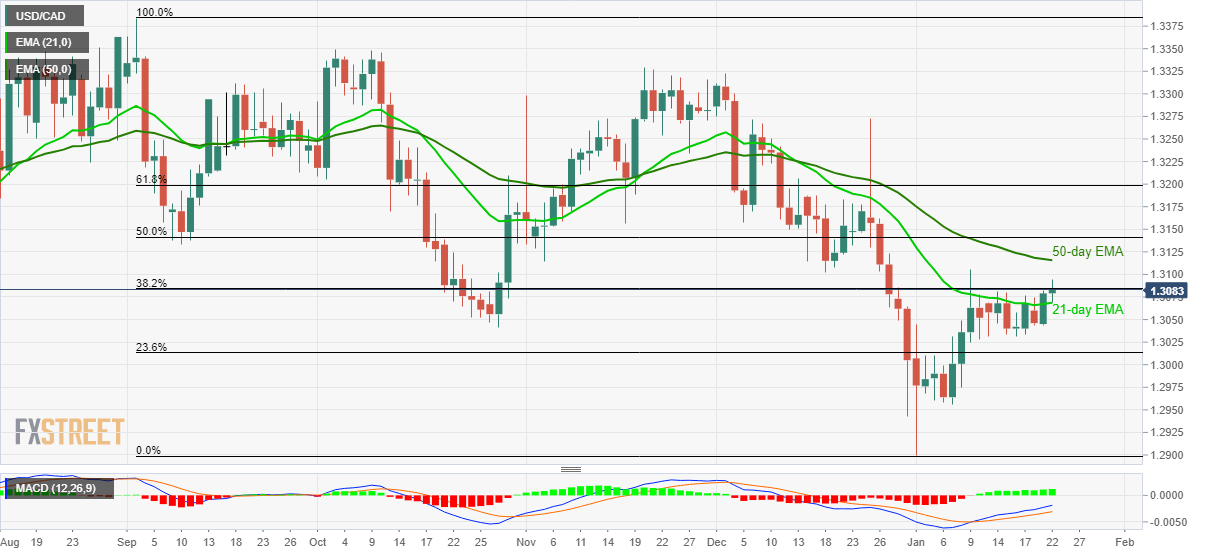

USD/CAD Price Analysis: Bulls cheer 21-day EMA break near nine-day high

- USD/CAD extends gains after multiple days of trading below 21-day EMA.

- 50-day EMA, 50% Fibonacci retracement on the bull’s radar.

- 1.3030 can return to the chart during the pullback.

USD/CAD takes the bids near 1.3085, the highest in two weeks, during the pre-European session on Wednesday. In doing so, the pair holds onto gains after successfully breaking 21-day EMA on a daily closing basis the previous day.

The buyers are now aiming 50-day EMA level of 1.3116 as the immediate resistance ahead of 50% Fibonacci retracement of the pair’s declines from September 2019 to January 01 low, near 1.3145.

In a case where the bulls remain dominant post-1.3145, 1.3180/85 has multiple upside barriers ahead of confronting 61.8% of Fibonacci retracement near 1.3200.

On the flip side, sellers will look for entry below the 21-day EMA level of 1.3070 while targeting the 1.3030 support level.

During the quote’s further downside below 1.3030, 1.3000 and 1.2960 can entertain the bears.

USD/CAD daily chart

Trend: Bullish