Back

20 Jan 2020

EUR/JPY Price Analysis: Door open for a corrective downside

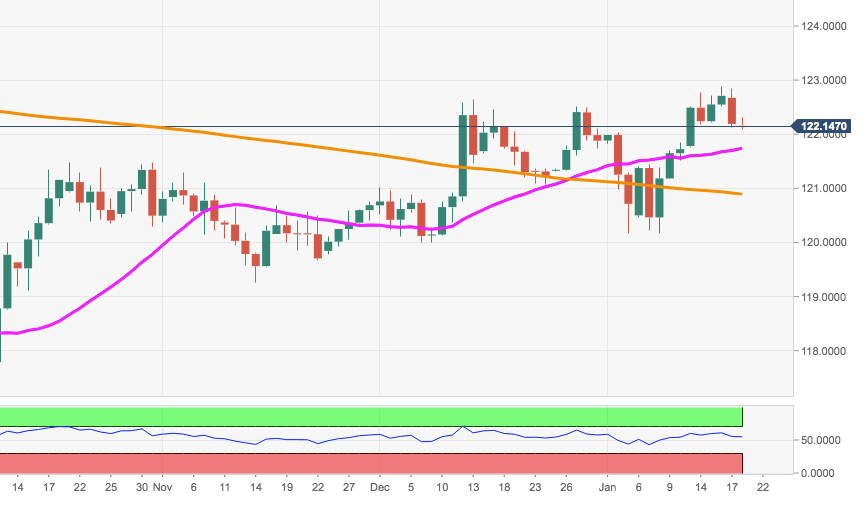

- The bull run in EUR/JPY met strong resistance near 123.00.

- The inability to regain recent tops could trigger some correction.

The upside momentum in EUR/JPY appears to have run out of steam in the vicinity of the key barrier at 123.00 the figure, sparking a sharp correction to the 122.00 neighbourhood.

The selling pressure could extend further and force the cross to initially recede to the 21-day SMA in the 121.70 region. Further south, the 200-day SMA around 120.90 should offer relevant contention. The renewed selling mood is reinforced by the divergence in the daily RSI.

While above the 200-day SMA at 120.91 the outlook on the cross is expected to remain constructive.

EUR/JPY daily chart