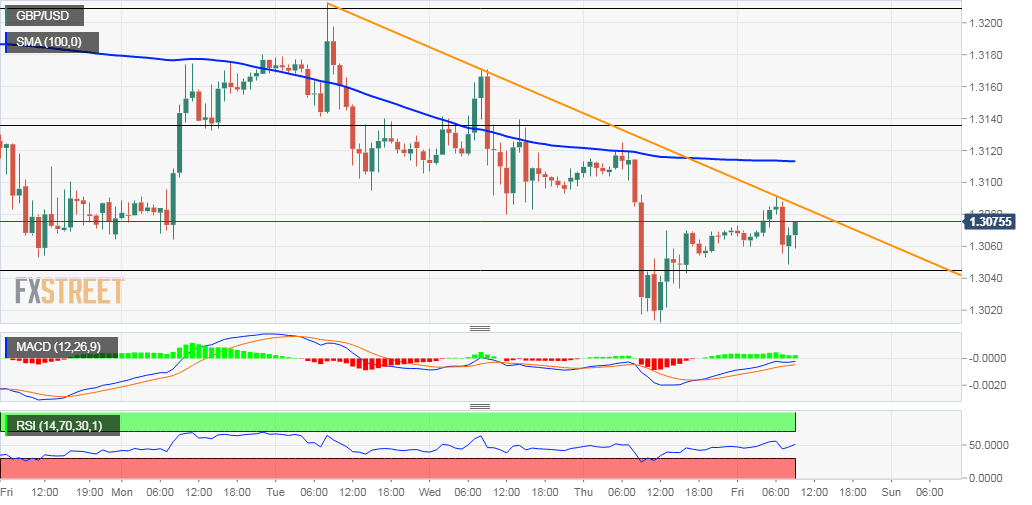

GBP/USD Technical Analysis: Bulls await a move beyond weekly descending trend-line hurdle

- GBP/USD remains on the defensive near two-week lows.

- The set-up warrants some caution for aggressive traders.

The GBP/USD pair continued with its struggle to capitalize on the attempted intraday positive move and remained well within the striking distance of two-week lows set in the previous session.

Friday's intraday uptick faltered near a four-day-old descending trend-line resistance, which should now act as a key pivotal point for short-term traders and help grab some short-term opportunities.

Meanwhile, mixed technical indicators on hourly/daily charts haven't been supportive of any firm near-term direction and thus, warrant some caution before placing any aggressive bets.

Currently hovering around the 23.6% Fibonacci level of the 1.3515-1.2905 downfall, any further slide might continue to attract some buying ahead of the key 1.30 psychological mark.

Failure to defend the mentioned handle might turn the pair vulnerable to accelerate the fall towards its next major support near the 1.2925 horizontal zone ahead of the 1.2900 round-figure mark.

On the flip side, momentum beyond the trend-line hurdle might confront some resistance near the 1.3100 handle, which is closely followed by 100-hour SMA and the 1.3130-35 region (38.2% Fibo.).

Some follow-through buying has the potential to lift the pair further beyond the 1.3160 intermediate resistance towards reclaiming the 1.3200 round-figure mark (50% Fibo.).

GBP/USD 1-hourly chart