Back

9 Jul 2019

S&P500 Index technical analysis: US stocks ends Tuesday in the green near the 2,980 level

- The S&P500 is up on the day close to 2,895 resistance.

- Immediate supports are seen at the 2,965 and 2,950 levels.

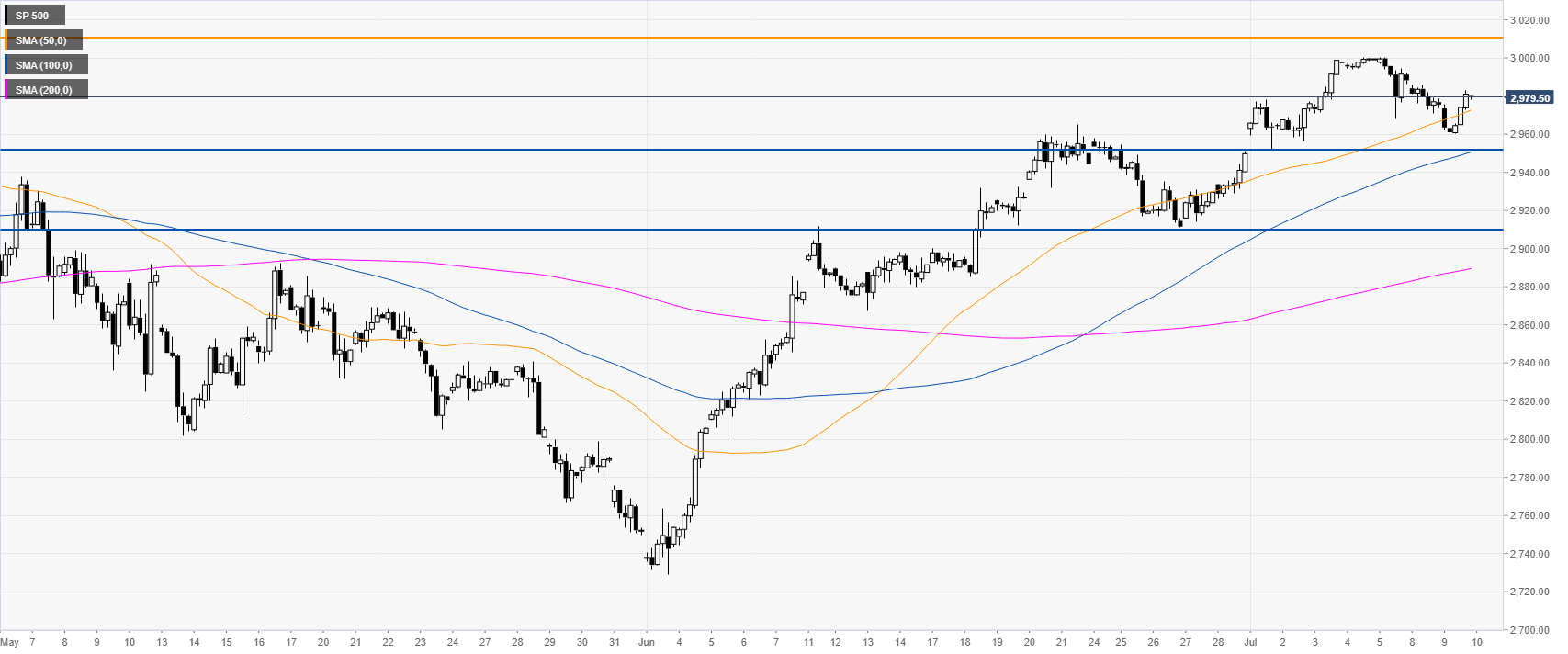

S&P500 daily chart

The S&P500 is retreating below the 3,000 handle. Bulls want to break above this level to continue to travel towards the 3,010 and 3,045 level.

S&P500 4-hour chart

The market is finding some support above 2,950 and the 50 SMA. The index is trading above its main simple moving averages (SMAs) suggesting bullish momentum in the medium term.

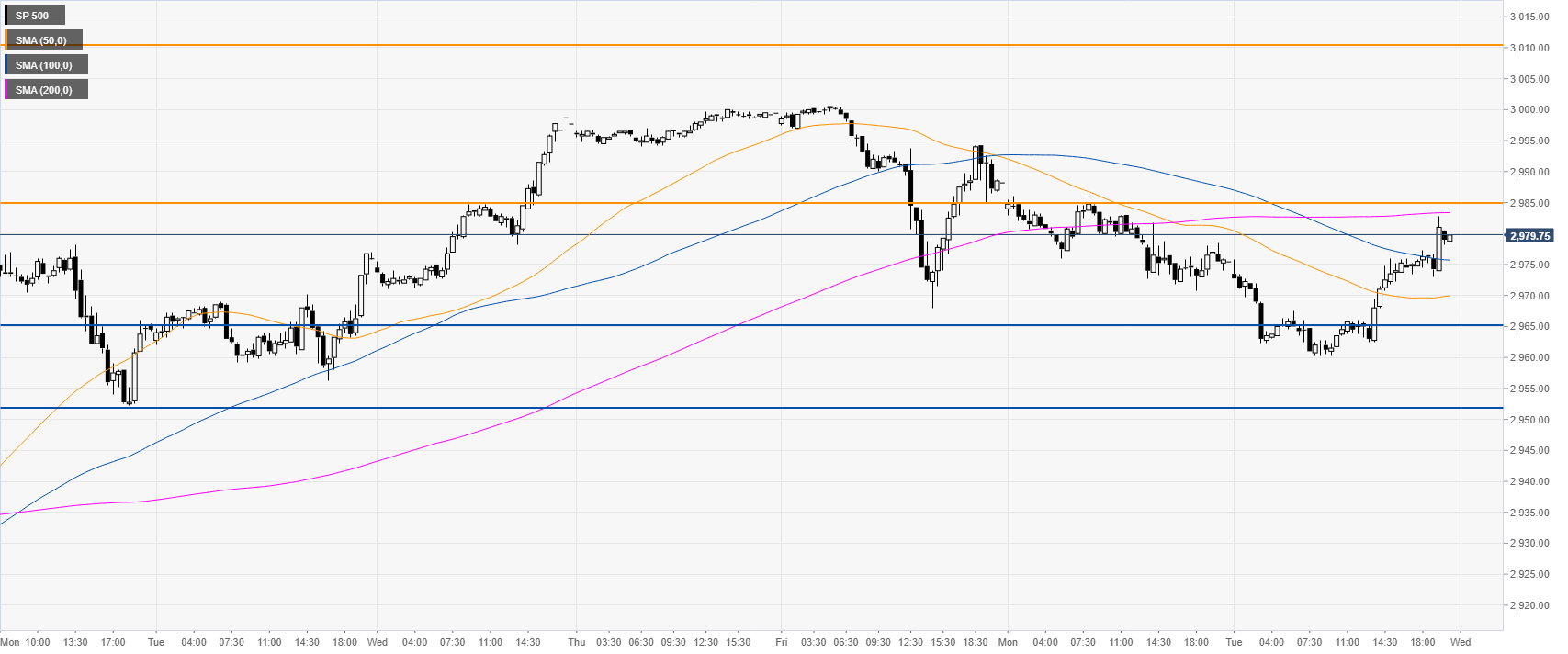

S&P500 30-minute chart

The S&P500 is about to test the 2,985 resistance and the 200 SMA. A bullish failure would lead to 2,965 key support and the 2,950 level. Further down lies 2,910 which can can become the next support.

Additional key levels