Back

8 Mar 2019

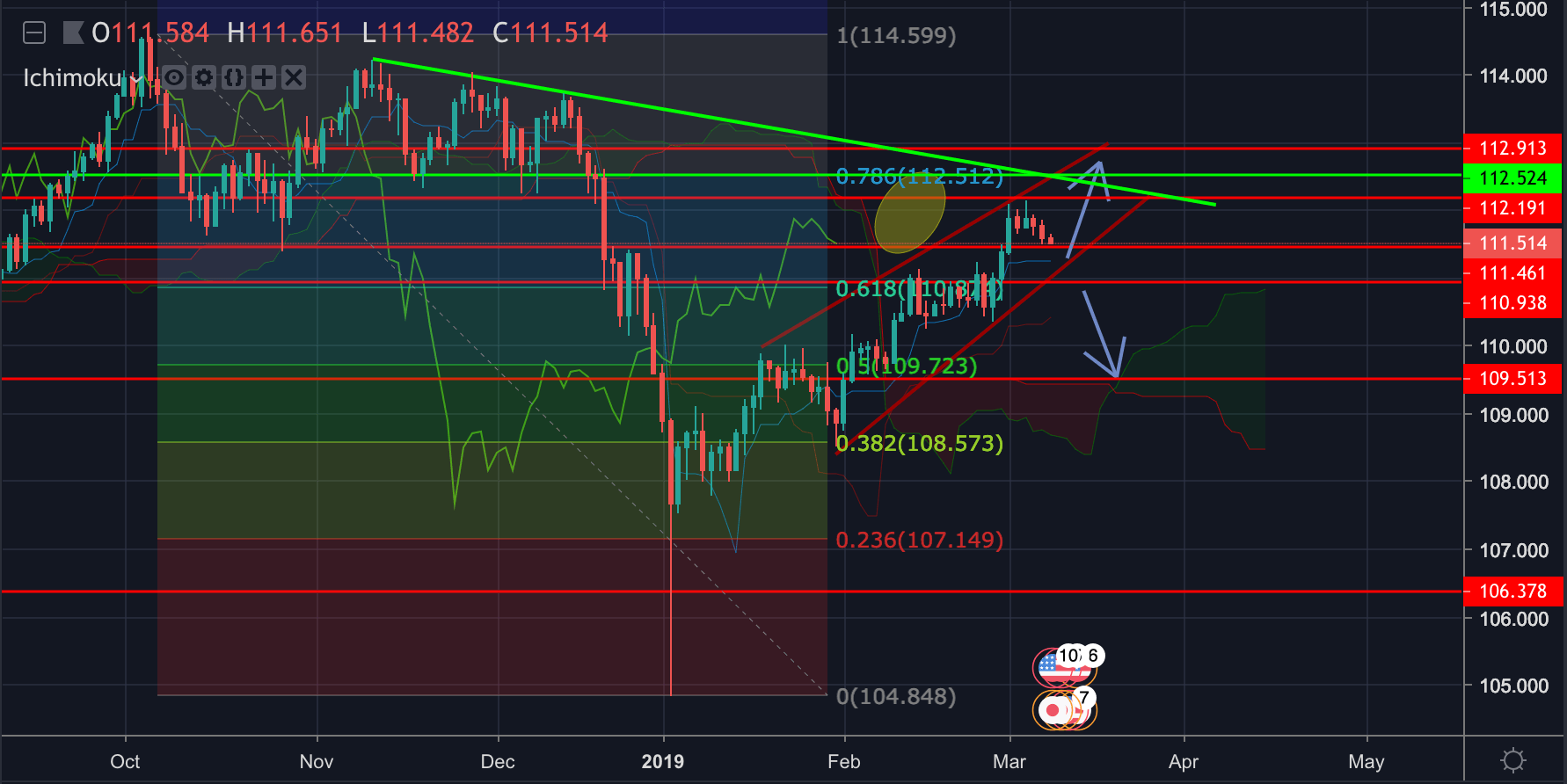

USD/JPY: Technical Analysis: Daily Ichimoku Cloud long-entry set-up in development; target 113.60/114.20

- USD/JPY is at a crossroads on a techncial outlook - So far, unable to find commitments from the bulls to get over the 112 line.

- However, while holding above 111.20/50, the outlook remains bullish.

- The daily Ichimoku Cloud is not quite meeting the full criteria for a long with a sustained upside projection target.

The four criteria should be as follows:

- Price must close above the Cloud.

- Cloud ahead must be bullish (green).

- Conversion Line is greater than the baseline.

- Lagging Span is greater than or crosses above the cloud.

- The Lagging span is not above the cloud, (thick green price line in the chart below targetting the space where the eclipse has been drawn above the cloud).

- A break of 112.20 would be a low-risk long entry with a tight stop, targetting a break of the 112.52 horizontal 78.6% Fibo resistance line with the Lagging Spab through the eclipse completing the criteria for a sustained trailing stop long entry position.

- Target break of 113.60 trend line resistance for 114.20.

- Failure at the 61.8% Fibo and channel support opens risk back to 109.50 cloud support.

USD/JPY Daily Chart