Back

21 Feb 2019

Gold Technical Analysis: Pullback to ascending 5-day MA likely

Gold is currently trading at $1,340, having clocked a high of $1,346.85 yesterday.

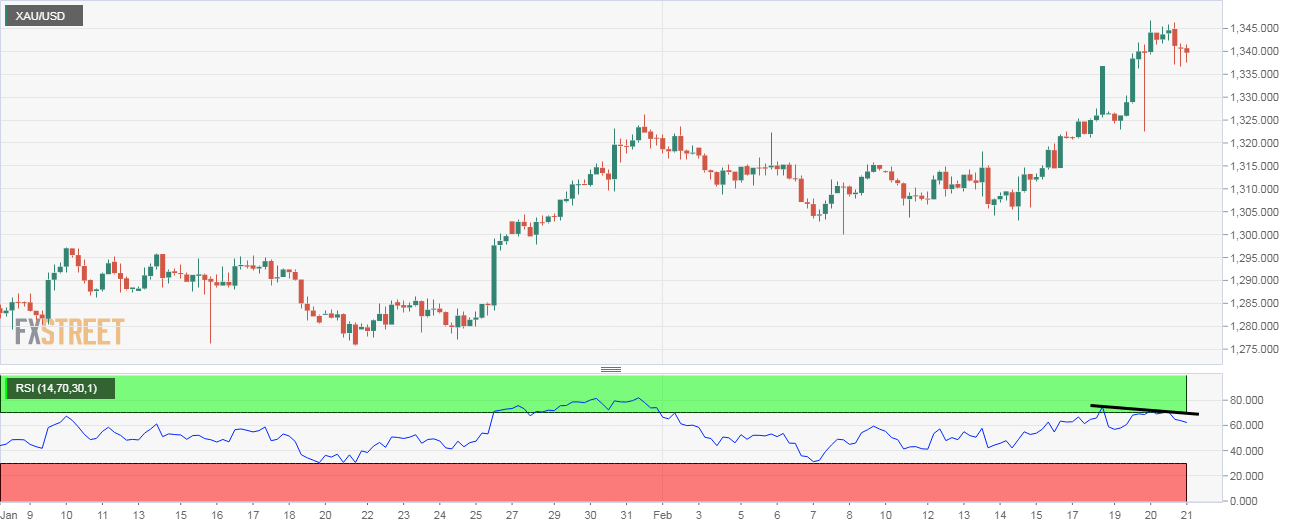

On the daily chart, the safe haven yellow metal carved out a doji candle yesterday, signaling indecision/bullish exhaustion. Further, on the 4-hour chart, the RSI has diverged in favor of the bears.

Therefore, the yellow metal could fall back to the ascending 5-day moving average (MA) support, currently lined up $1,335.

Daily chart

-636863164225059774.png)

4-hour chart

Trend: Minor correction likely