Back

20 Feb 2019

JPY futures: dips appear shallow

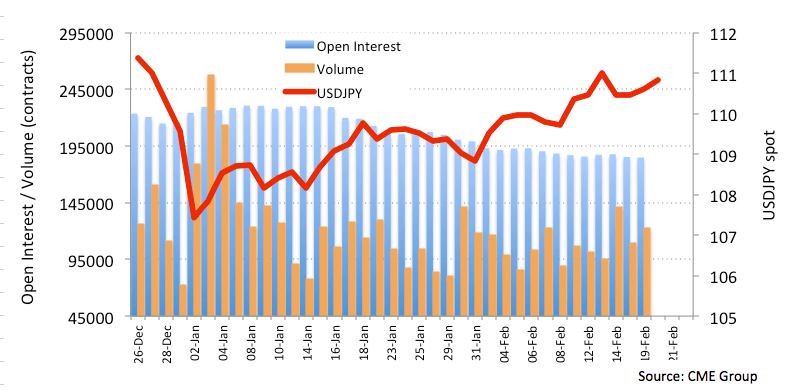

Flash data for JPY futures markets from CME Group noted investors scaled back their open interest positions by just 347 contracts on Tuesday from Friday’s final 185,212 contracts, clinching the second straight drop. Volume, instead, rose by nearly 13.2K contracts, prolonging the choppy performance as of late.

USD/JPY upside faces strong resistance around 111.00

Shrinking open interest coupled with the recent negative price action around the safe haven JPY could not only limit the upside in USD/JPY, but also motivate a correction lower. The lack of direction in volume is also pointing to some consolidation in the near term, while recent peaks in the pair above the 111.00 handle remains a tough nut to crack.