Back

18 Feb 2019

Oil Technical Analysis: Wedge pattern halts bullish advance near $56.80 a barrel

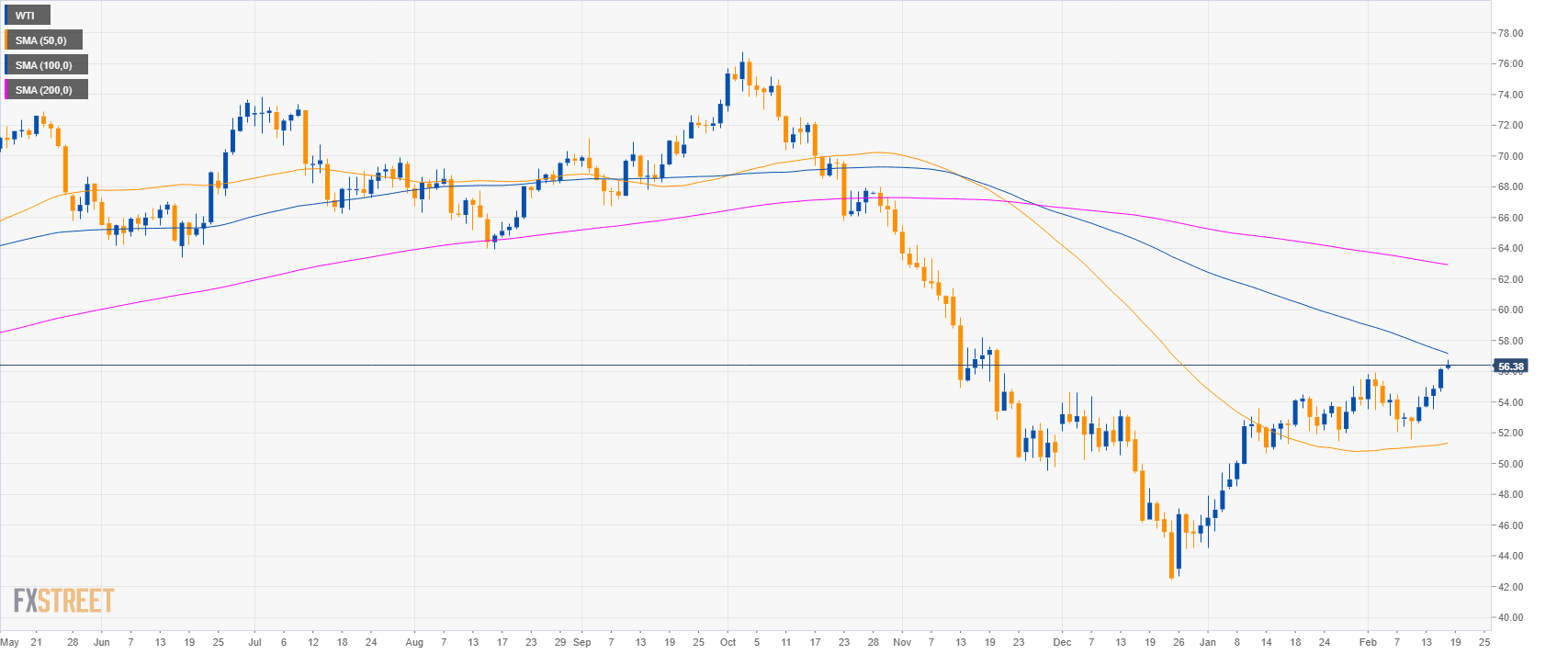

Oil daily chart

- Crude oil WTI is trading between the 50 and 100 SMA suggesting a sideways market.

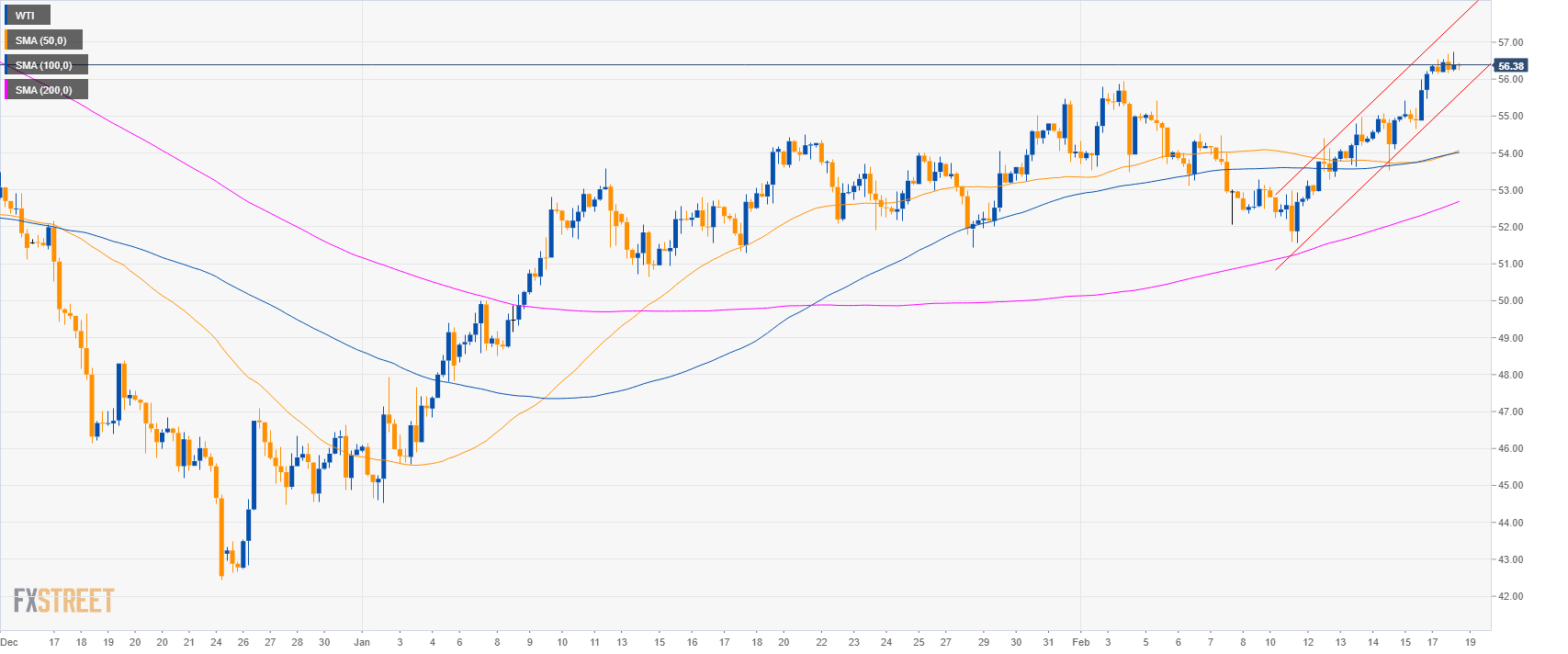

Oil 4-hour chart

- Crude oil is trading above the main SMAs suggesting bullish momentum in the medium-term.

- Crude oil is trading in a tight bull channel.

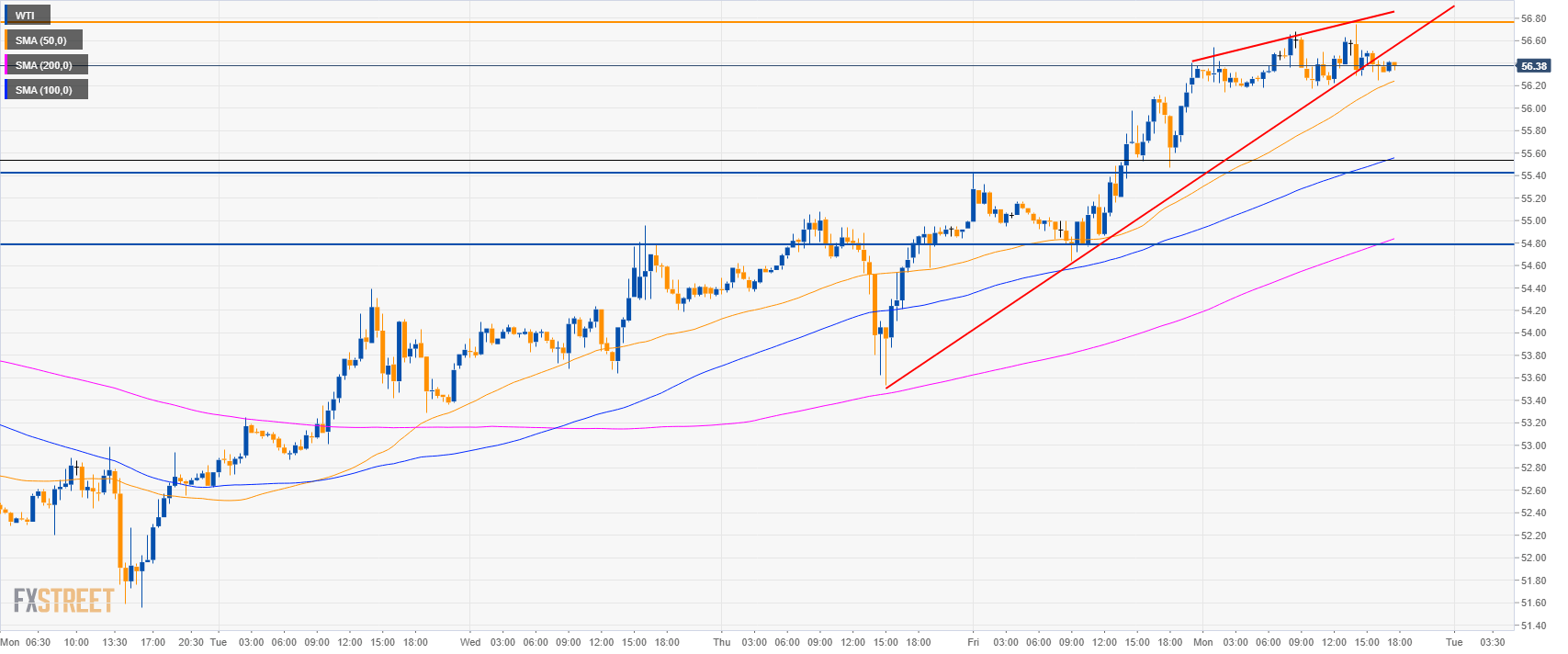

Oil 30-minute chart

- WTI is trading above its main SMAs suggesting bullish momentum in the short-term.

- However, the wedge pattern might see 55.40 and possibly 54.80 revisited to the downside before renewed bullish momentum resumes.

- Resistance is at $56.80 a barrel.

Additional key levels

WTI

Overview:

Today Last Price: 56.38

Today Daily change %: 0.43%

Today Daily Open: 56.14

Trends:

Daily SMA20: 53.85

Daily SMA50: 51.23

Daily SMA100: 55.89

Daily SMA200: 62.86

Levels:

Previous Daily High: 56.22

Previous Daily Low: 54.64

Previous Weekly High: 56.22

Previous Weekly Low: 51.56

Previous Monthly High: 55.48

Previous Monthly Low: 44.52

Daily Fibonacci 38.2%: 55.62

Daily Fibonacci 61.8%: 55.24

Daily Pivot Point S1: 55.11

Daily Pivot Point S2: 54.09

Daily Pivot Point S3: 53.53

Daily Pivot Point R1: 56.69

Daily Pivot Point R2: 57.25

Daily Pivot Point R3: 58.27