Back

8 Feb 2019

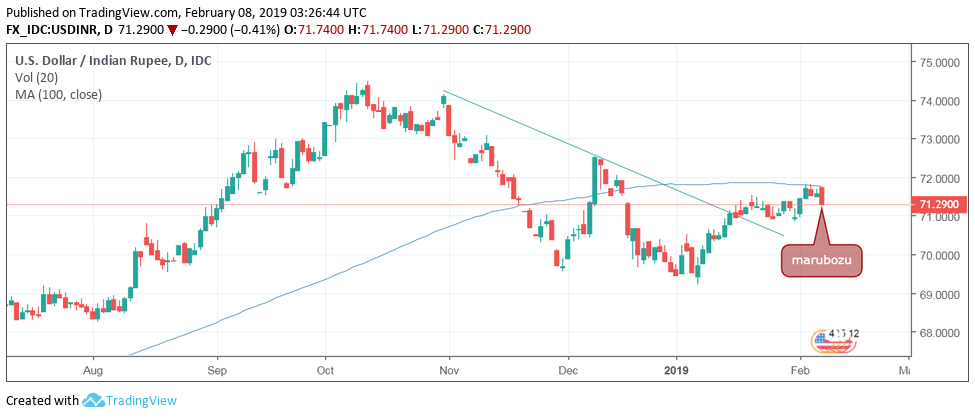

USD/INR Technical Analysis: Downside favored after bearish Marubozu, bulls need break above 100-day MA

The USD/INR pair fell 0.41 percent yesterday – its biggest single-day decline since Jan. 4 – and could extend the drop to 71.00 today.

Daily chart

The pair charted a bearish Marubozu candle yesterday, which essentially means the bears remained in control throughout the day.

The back-to-back rejections at the 100-day moving average (MA) and the strong bearish follow-through (Marubozu) has invalidated the bullish view put forward by the wedge breakout, confirmed on Jan. 18.

As a result, the support at 71.00-70.86 (Jan. 31 low) could soon come into play.

A daily close above the 100-day MA, currently at 71.77, would revive the bullish view.

Trend: bearish