US Dollar extends the upside above 89.00

- DXY firm above 89.00.

- USD decoupled from US yields.

- US markets closed on Washington’s Day.

The greenback, tracked by the US Dollar Index (DXY), is adding to Friday’s gains above the 89.00 handle amidst thin trade conditions due to the holiday in the US.

US Dollar focused on FOMC

The index is posting decent gains beyond 89.00 the figure at the beginning of the week, as the risk-on rally that prevailed for most of last week seems to be taking a breather.

In the meantime, Washington’s Day holiday in the US markets today is expected to drain markets of liquidity and volatility, opening the door at the same time for a very near term consolidative theme.

In the broader picture, USD has decoupled from the performance of yields in the US 10-year reference since the start of this year, all in response to increasing concerns over prospects of rising US deficits.

What will we be looking at around the buck? In the short term, Mueller’s allegations should be in centre stage although unlikely to have a meaningful market reaction, while protectionism, risk appetite trends, renewed deficit concerns, higher inflation and liquidity conditions remain poised to drive the sentiment around the greenback in the medium to longer run.

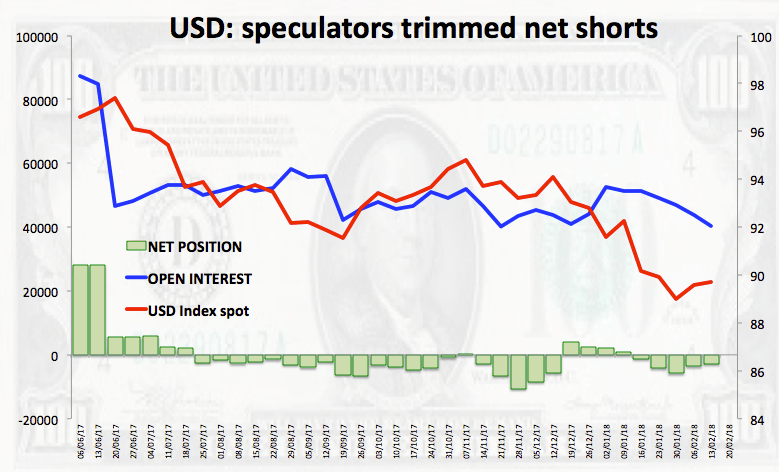

In addition, USD net shorts retreated to the lowest levels in the last 4 weeks during the week ended on February 13, according to the latest CFTC report.

US Dollar relevant levels

As of writing the index is up 0.05% at 89.20 and a break above 89.50 (21-day sma) would aim for 89.64 (10-day sma) and then 90.57 (high Feb.8). On the flip side, the immediate support aligns at 88.26 (2018 low Feb.16) seconded by 88.13 (200-month sma) and finally 86.88 (support line off 72.70).