EUR/USD drops further post-US data, near 1.0530

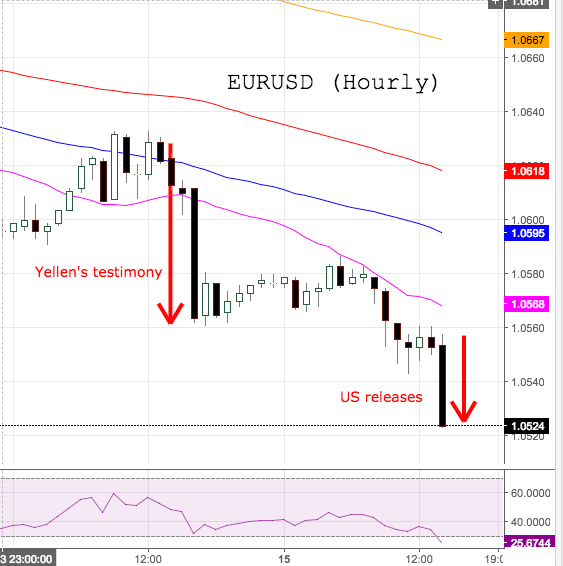

EUR/USD met extra downside pressure in the wake of US releases today, dropping to fresh lows in the 1.0530 region.

EUR/USD weaker post-data

Spot tested fresh lows after US inflation figures tracked by the CPI showed headline consumer prices have risen 2.5% on a year to January, while Core prices rose 2.3% on a yearly basis, both prints coming in above expectations.

Further data saw Retail Sales also surprising to the upside, expanding 0.6% inter-month and 0.8% MoM excluding the Autos sector. In addition, the Empire State manufacturing index jumped to 18.7 for the month of February, crushing prior estimates.

The pair remains well in the negative territory ahead of the second testimony by Chair Yellen, further US releases and Fedspeak.

EUR/USD levels to watch

At the moment the pair is retreating 0.45% at 1.0529 and a breach of 1.0452 (low Jan.11) would open the door to 1.0339 (2017 low Jan.3). On the upside, the immediate hurdle aligns at 1.0587 (high Feb.15) followed by 1.0603 (55-day sma) and finally 1.0696 (20-day sma).