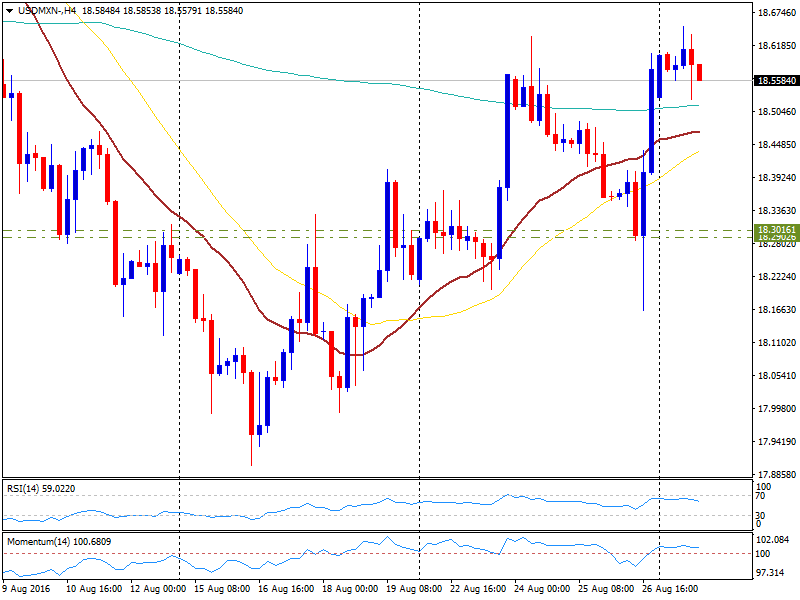

USD/MXN consolidates above 18.50

The Mexican peso dropped sharply against the US dollar on Friday on a very volatile session and today it moved sideways most of the day, consolidating above 18.50.

On Friday initially, USD/MXN dropped to 18.16, reaching the lowest level in a week but then bounced sharply to the upside, amid a rally of the US dollar in the market. Today it continued to move to the upside and climbed to 18.65, the strongest level since August 8. From there it pulled back modestly and it was trading around 18.55.

The pair holds a bullish tone in the short-term. A decline below 18.30 could strengthen the Mexican peso.

Data ahead

In the US, on Friday key economic data will be released with the non-farm payroll report. In Mexico, on Wednesday the central bank (Banxico) will publish the quarterly inflation report and on Thursday Markit will present the PMI index.