Back

21 Sep 2023

Crude Oil Futures: A sustained drop seems unlikely

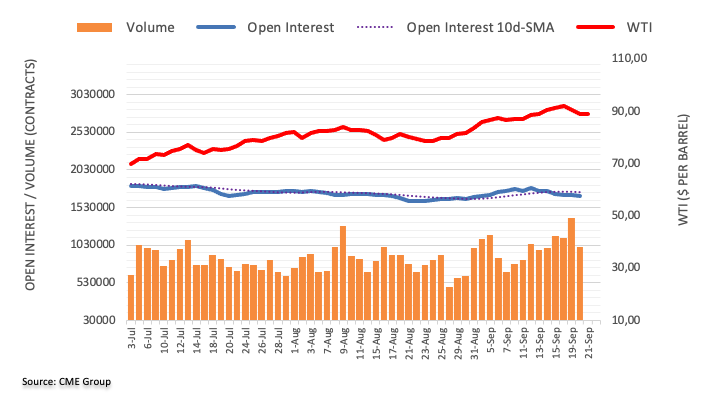

CME Group’s flash data for crude oil futures markets noted traders reduced their open interest positions for yet another session on Wednesday, this time by around 9.5K contracts. In the same line, volume remained choppy and went down by around 382.1K contracts, setting aside the previous daily build.

WTI: Further downside appears contained

WTI prices extended the rejection from the 2023 high, breaking below the key $90.00 barrier per barrel on Wednesday. The downtick was on the back of shrinking open interest and volume and suggests that a sustained decline appears not favoured for the time being. On the downside, there is a provisional support at the 55-day SMA, today at $81.87.