Back

22 Nov 2022

Gold Futures: Rebound in the offing?

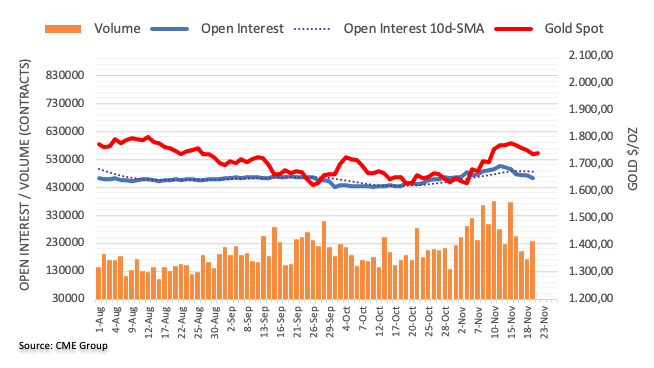

CME Group’s flash data for gold futures markets showed open interest extended the downtrend for yet another session on Monday, this time by around 8.4K contracts. Volume, instead, rose by around 65.3K contracts after three consecutive daily builds.

Gold could revisit the $1,770 region

Monday’s drop to multi-session lows near $1,730 was amidst shrinking open interest and this is supportive of a short-term rebound in gold to, initially, the $1,770 zone (November 18).