Back

18 Nov 2022

Natural Gas Futures: Further gains not ruled out

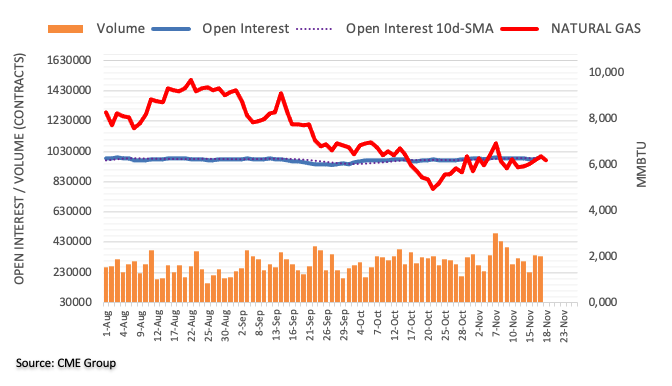

CME Group’s flash data for natural gas futures markets noted traders added around 9.2K contracts to their open interest positions on Thursday. Volume, instead, resumed the downtrend and shrank by nearly 9K contracts, partially offsetting the previous strong build.

Natural Gas: Next target comes at the 200-day SMA

Prices of the natural gas rose for the fourth consecutive session on Thursday. The move was in tandem with another uptick in open interest, which is supportive of the continuation of the leg higher in the very near term. Against that, the commodity could be in course to revisit the key hurdle at the 200-day SMA, today near $6.85 per MMBtu.